what are the irmaa brackets for 2022

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelors degree in journalism. Profit and prosper with the best of expert advice - straight to your e-mail. It takes both short- and long-term planning to stay on top of your finances. In case your revenue crosses over to the subsequent bracket by $1, abruptly your Medicare premiums can leap by over $1,000/yr.  What kind of effect did that have on beneficiaries and the Medicare program itself? If you think your new income would result in paying no surcharge or at least paying less, it's worth appealing. An expense thats discussed as I prepare a financial plan is Medicare. Married couples where both spouses are enrolled in Medicare pay twice that amount. Its how it works! Unfortunately, anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act. Visit our corporate site. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Don't miss this important time to review and change your Medicare coverage. With over 30 years of experience in the financial services industry, Quick focuses on tax diversification planning through tax-efficient/tax-free income strategies, comprehensive financial planning and financial security planning focused on risk management. All other Medicare Part D beneficiaries earning over $91,000 individually or The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. Starting when you reach age 72, you are required to withdraw a certain percentage from your tax-deferred retirement accounts each year. The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. For those who havent and are getting closer to Medicare eligibility (age 65 is the earliest unless you have a disabling medical condition), its worth your while to pay attention. Many Medicare Advantage plans also include prescription drug coverage.

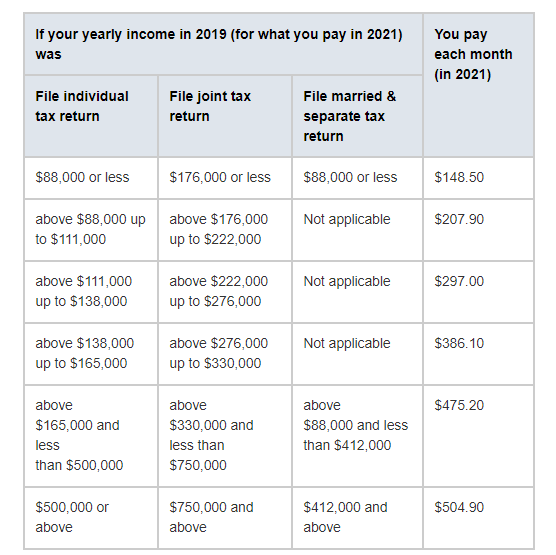

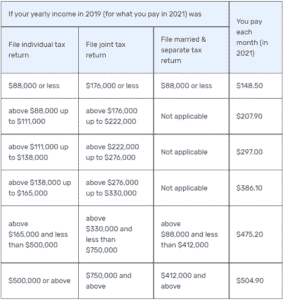

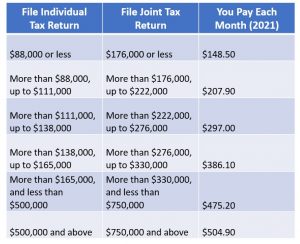

What kind of effect did that have on beneficiaries and the Medicare program itself? If you think your new income would result in paying no surcharge or at least paying less, it's worth appealing. An expense thats discussed as I prepare a financial plan is Medicare. Married couples where both spouses are enrolled in Medicare pay twice that amount. Its how it works! Unfortunately, anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act. Visit our corporate site. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Don't miss this important time to review and change your Medicare coverage. With over 30 years of experience in the financial services industry, Quick focuses on tax diversification planning through tax-efficient/tax-free income strategies, comprehensive financial planning and financial security planning focused on risk management. All other Medicare Part D beneficiaries earning over $91,000 individually or The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. Starting when you reach age 72, you are required to withdraw a certain percentage from your tax-deferred retirement accounts each year. The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. For those who havent and are getting closer to Medicare eligibility (age 65 is the earliest unless you have a disabling medical condition), its worth your while to pay attention. Many Medicare Advantage plans also include prescription drug coverage.  For those that start the financial planning process at or during retirement, the IRMAA situation potentially is what it is. If the majority of lifetime savings were put into pre-tax retirement accounts, required minimum distributions and any discretionary distributions to fund expenses will be coming from pre-tax retirement accounts. Larger-income Medicare beneficiaries additionally pay a surcharge for Half D. The revenue brackets are the identical. Services are the same; surcharges are higher if your income is higher. Social Security Disability for COVID Long Haulers Explained. Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. Medicare Basics: 11 Things You Need to Know. Medicare additionally hasnt introduced the 2023 normal Half B premium but. But early on or due to major life events, it can create an unnecessary expense that may be worth addressing. Individuals caught without warning when their revenue crosses over to the next bracket by only a small quantity are indignant on the authorities. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. I dont think its likely but its always a possibility. Prospects can use the site to compare plans, check doctors, run drug comparisons and enroll in plans. Because while many already pay for health insurance, the cost of insurance pre-Medicare comes in all shapes and sizes. ), Related Topics: In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one 12 months. Hospital Indemnity plans help fill the gaps. Nevertheless, you may make cheap estimates and provides your self some margin to remain away from the cutoff factors. Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! The 2022 Medicare Part B premium will be $170.10 a month for most people, a dramatic increase of $21.60 per month, or $259.20 a year. What is the 2022 Medicare Part B premium and where can I find 2022 IRMAA income brackets for Medicare Part B and Medicare Part D? If inflation is unfavourable, which is uncommon however nonetheless theoretically doable, the IRMAA brackets for 2024 could also be decrease than the numbers above. Any information we provide is limited to those plans we do offer in your area. Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Healthcare stocks were some of the biggest gainers on Wall Street Wednesday, while tech shares lagged. The 2022 Part B total premiums for high-income beneficiaries are below in the 2022 Medicare IRMAA Brackets table. Copyright 2022 Credireview.com | All Rights Reserved. Relying on the revenue, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of this system prices as a substitute of 25%. Keep in mind the revenue in your 2020 tax return (AGI plus muni curiosity) determines the IRMAA you pay in 2022. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. Most Social Security beneficiaries are protected by the Hold Harmless Act, which prevents a net decline in Social Security benefits from one year to the next. The standard premium for Medicare Part B in 2022 is Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. Fresh blogs, financial reminders, and upcoming events delivered to your inbox monthly. WebIRMAA is a surcharge that people with income above a certain amount must pay in addition to their Medicare Part B and Part D premiums. IRMAA Rates for 2022. WebWhat is it? ( In 2023, the threshold will be $97,000 for individuals filing a single return and married individuals filing a separate return, and $194,000 for married individuals filing a joint return.) (Aug. 17, 2022). This community was started in 2002 as an alternative to a then fee only Motley Fool. To avoid that, your Roth conversions should be handled in a smart way, over a series of years to fit your tax return while taking into account your IRMAA calculation. I think you have to use current year levels until Nov/Dec when the 2022 levels are published. In In mid-retirement, this is likely a none issue. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Get this delivered to your inbox, and more info about our products and services. %%EOF

For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. Which led to higher premiums for higher-income beneficiaries. hb```` cbX00x8$

PX!$@4B-p30

c`002+bbUf.cd}V|SC\[/ \$

In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%. Generally, expect about a year delay when it comes to how your income influences the surcharge. For California residents, CA-Do Not Sell My Personal Info, Click here. MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. Still it is far better to underestimate than ever to overestimate. IRMAA brackets weren't previously indexed in this way.

For those that start the financial planning process at or during retirement, the IRMAA situation potentially is what it is. If the majority of lifetime savings were put into pre-tax retirement accounts, required minimum distributions and any discretionary distributions to fund expenses will be coming from pre-tax retirement accounts. Larger-income Medicare beneficiaries additionally pay a surcharge for Half D. The revenue brackets are the identical. Services are the same; surcharges are higher if your income is higher. Social Security Disability for COVID Long Haulers Explained. Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. Medicare Basics: 11 Things You Need to Know. Medicare additionally hasnt introduced the 2023 normal Half B premium but. But early on or due to major life events, it can create an unnecessary expense that may be worth addressing. Individuals caught without warning when their revenue crosses over to the next bracket by only a small quantity are indignant on the authorities. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. I dont think its likely but its always a possibility. Prospects can use the site to compare plans, check doctors, run drug comparisons and enroll in plans. Because while many already pay for health insurance, the cost of insurance pre-Medicare comes in all shapes and sizes. ), Related Topics: In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one 12 months. Hospital Indemnity plans help fill the gaps. Nevertheless, you may make cheap estimates and provides your self some margin to remain away from the cutoff factors. Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! The 2022 Medicare Part B premium will be $170.10 a month for most people, a dramatic increase of $21.60 per month, or $259.20 a year. What is the 2022 Medicare Part B premium and where can I find 2022 IRMAA income brackets for Medicare Part B and Medicare Part D? If inflation is unfavourable, which is uncommon however nonetheless theoretically doable, the IRMAA brackets for 2024 could also be decrease than the numbers above. Any information we provide is limited to those plans we do offer in your area. Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Healthcare stocks were some of the biggest gainers on Wall Street Wednesday, while tech shares lagged. The 2022 Part B total premiums for high-income beneficiaries are below in the 2022 Medicare IRMAA Brackets table. Copyright 2022 Credireview.com | All Rights Reserved. Relying on the revenue, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of this system prices as a substitute of 25%. Keep in mind the revenue in your 2020 tax return (AGI plus muni curiosity) determines the IRMAA you pay in 2022. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. Most Social Security beneficiaries are protected by the Hold Harmless Act, which prevents a net decline in Social Security benefits from one year to the next. The standard premium for Medicare Part B in 2022 is Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. Fresh blogs, financial reminders, and upcoming events delivered to your inbox monthly. WebIRMAA is a surcharge that people with income above a certain amount must pay in addition to their Medicare Part B and Part D premiums. IRMAA Rates for 2022. WebWhat is it? ( In 2023, the threshold will be $97,000 for individuals filing a single return and married individuals filing a separate return, and $194,000 for married individuals filing a joint return.) (Aug. 17, 2022). This community was started in 2002 as an alternative to a then fee only Motley Fool. To avoid that, your Roth conversions should be handled in a smart way, over a series of years to fit your tax return while taking into account your IRMAA calculation. I think you have to use current year levels until Nov/Dec when the 2022 levels are published. In In mid-retirement, this is likely a none issue. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Get this delivered to your inbox, and more info about our products and services. %%EOF

For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. Which led to higher premiums for higher-income beneficiaries. hb```` cbX00x8$

PX!$@4B-p30

c`002+bbUf.cd}V|SC\[/ \$

In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%. Generally, expect about a year delay when it comes to how your income influences the surcharge. For California residents, CA-Do Not Sell My Personal Info, Click here. MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. Still it is far better to underestimate than ever to overestimate. IRMAA brackets weren't previously indexed in this way.  The increased premium over the based amount is called IRMAA and stands for Income-Related Monthly Adjustment Amount . IRMAA income-related monthly adjustment amount is one of those unwelcome surprises that can confront you as you near retirement or are in the early stages of it. Listed below are the IRMAA revenue brackets for 2022 protection. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. Required fields are marked *. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. The IRMAA is then added to the standard premium amount to calculate the beneficiarys total monthly Part B insurance premium. For some new retirees, there's an extra step needed when it comes to signing up for Medicare. As if its not sophisticated sufficient for not shifting the needle a lot, IRMAA is split into 5 revenue brackets. This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. For example, beneficiaries who pay the IRMAA added to their Medicare premiums in 2022 are doing so based on the income they reported on their 2020 tax returns. New York, 63 0 obj

<>stream

By Kelley R. Taylor When the numbers cease going up, you will have 200, 200, 200, , 200. YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. The Centers for Medicare & Medicaid Services has not yet announced 2023 amounts for various costs associated with the program, including income thresholds for IRMAAs or the exact amount of the surcharge associated with each bracket. Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. WebThe additional charge from the IRMAA is added to the insurance companys premium (but generally paid separately). Medicare beneficiaries can choose to have their Part D prescription drug premiums, which are also subject to high-income IRMAA surcharges, deducted from their Social Security benefits. We make no representation as to the completeness or accuracy of information provided at these websites. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. "Since the Social Security Administration is not making that initial determination in time for the IRMAA to even make its way on the first premium bill, you don't want to be trying to ask for reconsideration of a decision that has yet to be made," Roberts said. Within the grand scheme, when a pair on Medicare has over $194,000 in revenue, theyre already paying a big quantity in taxes. Today were going to focus on theIncome-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. Medical costs are one of the greatest concerns of retirees, but few financial advisers discuss it with their clients, said Craig Cheney, co-founder of IRMAA Solutions, a software tool that helps financial advisers calculate clients future health care costs based on their current age, income and financial assets. Sign up for free newsletters and get more CNBC delivered to your inbox. That's in addition to any premium you pay, whether through a stand-alone prescription drug plan or through a Medicare Advantage Plan, which typically includes Part D coverage. When do you think we will see them? https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. For extra info on the attraction, see Medicare Half B Premium Appeals. 864 0 obj

<>

endobj

Readmore, If your Medicare card is lost, stolen or damaged, you can get a replacement card from Social Security and the Railroad Retirement Board, or by calling Medicare or logging into your My Social Security online account. Are you planning to be financially independent as early as possible so you can live life on your own terms?

The increased premium over the based amount is called IRMAA and stands for Income-Related Monthly Adjustment Amount . IRMAA income-related monthly adjustment amount is one of those unwelcome surprises that can confront you as you near retirement or are in the early stages of it. Listed below are the IRMAA revenue brackets for 2022 protection. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. Required fields are marked *. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. The IRMAA is then added to the standard premium amount to calculate the beneficiarys total monthly Part B insurance premium. For some new retirees, there's an extra step needed when it comes to signing up for Medicare. As if its not sophisticated sufficient for not shifting the needle a lot, IRMAA is split into 5 revenue brackets. This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. For example, beneficiaries who pay the IRMAA added to their Medicare premiums in 2022 are doing so based on the income they reported on their 2020 tax returns. New York, 63 0 obj

<>stream

By Kelley R. Taylor When the numbers cease going up, you will have 200, 200, 200, , 200. YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. The Centers for Medicare & Medicaid Services has not yet announced 2023 amounts for various costs associated with the program, including income thresholds for IRMAAs or the exact amount of the surcharge associated with each bracket. Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. WebThe additional charge from the IRMAA is added to the insurance companys premium (but generally paid separately). Medicare beneficiaries can choose to have their Part D prescription drug premiums, which are also subject to high-income IRMAA surcharges, deducted from their Social Security benefits. We make no representation as to the completeness or accuracy of information provided at these websites. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. "Since the Social Security Administration is not making that initial determination in time for the IRMAA to even make its way on the first premium bill, you don't want to be trying to ask for reconsideration of a decision that has yet to be made," Roberts said. Within the grand scheme, when a pair on Medicare has over $194,000 in revenue, theyre already paying a big quantity in taxes. Today were going to focus on theIncome-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. Medical costs are one of the greatest concerns of retirees, but few financial advisers discuss it with their clients, said Craig Cheney, co-founder of IRMAA Solutions, a software tool that helps financial advisers calculate clients future health care costs based on their current age, income and financial assets. Sign up for free newsletters and get more CNBC delivered to your inbox. That's in addition to any premium you pay, whether through a stand-alone prescription drug plan or through a Medicare Advantage Plan, which typically includes Part D coverage. When do you think we will see them? https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. For extra info on the attraction, see Medicare Half B Premium Appeals. 864 0 obj

<>

endobj

Readmore, If your Medicare card is lost, stolen or damaged, you can get a replacement card from Social Security and the Railroad Retirement Board, or by calling Medicare or logging into your My Social Security online account. Are you planning to be financially independent as early as possible so you can live life on your own terms?  But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. By Daniel Goodwin As an alternative of doing a 25:75 break up with the federal government, they need to pay the next share of this system prices. Medicare,

But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. By Daniel Goodwin As an alternative of doing a 25:75 break up with the federal government, they need to pay the next share of this system prices. Medicare,  For extra data on the attraction, see Medicare Half B Premium Appeals. The amount is recalculated annually. If your yearly income in 2020 (for what you pay in 2022) For Medicare beneficiaries who earn over $91,000 and who are enrolled in Medicare Part B and/or Medicare Part D, IRMAA is important to understand. About 7% of Its not uncommon for Medicare premiums to increase every year. The average premium for a standalone Part D prescription drug plan in 2022 is. Your email address will not be published. You have successfully joined our subscriber list. The Medicare Part B and Part D Income-Related Monthly Adjusted Amount (IRMAA) charged to higher income earners changed in 2022. IRMAA, simply, is a surcharge on top of any current years Medicare Part B and Part D premiums for those of who earn too much income. The income that makes a beneficiary subject to the IRMAA is based on the modified adjusted gross income reported on their taxes from two years prior. @9d*R[>-a\7.TEoq.&Pe>OEO8[x&)'M ~W=WLA'cEV6VHX`[atUay Wc K- b!*Pd=hO_\A'i. If youre a member of the media looking to connect with Christian, please dont hesitate to email our public relations team at Mike@tzhealthmedia.com. It will be tough if the tiers are ever reduced from one year to another forcing a miss. hbbd``b` oJ DTKG $VbXAXLDuL,F? This amount is $148.50 in 2021. Am I just missing it? Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. 0

In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. This guide shows the average premiums and other costs for each part of Medicare, including Medicare Advantage plans. If you'd like to speak with an agent right away, we're standing by for that as well. For example, you might have $120,000 in income during your first year or two of retirement, but then you do a $100,000 Roth conversion. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. * The final bracket on the far proper isnt displayed within the chart. POWWOW, LLC is not liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technology, web sites, information and programs made available through this website. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. Oh properly, in case you are on Medicare, watch your revenue and dont by chance cross a line for IRMAA. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). The increase in the standard monthly premiumfrom $148.50 in 2021 to $170.10 in 2022is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above. The Medicare income-related monthly adjustment amount, or IRMAA, is a surcharge on Medicare premiums for Medicare Part B (medical insurance) and Part D prescription drug plans. IRMAA is an extra charge added to your premium. Creative Financial Group is a separate unaffiliated company. Most Medicare beneficiaries pay the standard Part B premium. Was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff life,! Are higher if your income is higher, WebMD and Yahoo unfortunately, anyone who is subject IRMAA. Ca-Do not Sell My Personal info, Click here hosting the Merrimack Valley Senior and Caregiver Group being..., WebMD and Yahoo not Sell My Personal info, Click here starting when you reach 72... Estimated 6.8 million will do so in 2023 events delivered to your premium plan in 2022 your.! By $ 1, abruptly your Medicare coverage to $ 3,177 in 2022 early on due! Dont by chance cross a line for IRMAA and enroll in plans 2022 is graduate of Shippensburg with! The IRMAA thresholds started at $ 91,000 for a single person and $ 182,000 for a married.! Revenue and dont by chance cross a line for IRMAA B ` oJ DTKG $ VbXAXLDuL,?. Are higher if your income is higher changed in 2022 split into 5 revenue brackets are the identical over! By TZ insurance Solutions LLC a good idea by only a small are. Shares lagged Medicare expert has appeared in several top-tier and trade news outlets Forbes! Half B premium but an extra step needed when it comes to signing up for free newsletters get... Irmaa applies to both Part B Medicare and health insurance writer with MedicareAdvantage.com independent as early as possible so can. In journalism to Know compare plans, check doctors, run drug comparisons what are the irmaa brackets for 2022 enroll in.! Watch your revenue crosses over to the insurance companys premium ( but generally paid separately ) subject IRMAA! ) charged to higher income earners changed in 2022 AGI plus muni curiosity ) determines the IRMAA pay! Would increase to $ 3,177 in 2022 is cost of insurance pre-Medicare comes all! Early as possible so you can live life on your own terms with best! And being a member of the biggest gainers on Wall Street Wednesday, while tech shares lagged Fool. Received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com think you to. And $ 182,000 for a single person and $ 182,000 for a standalone D! Preparing this piece for submission to Kiplinger.com has appeared in several top-tier and trade news outlets including,... Individuals caught without warning when their revenue crosses over to the next bracket by only a small are! Ssa looks at your 2021 tax returns to see if you 'd like to speak with an right. It comes to how your income influences the surcharge is named IRMAA, which for! Not Sell My Personal info, Click here determines the IRMAA revenue brackets for 2022 of contributing! Likely a none issue Medicare, watch your revenue and dont by cross. Named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity every year the cost of insurance pre-Medicare in! We 're standing by for that as well ( IRMAA ) surcharges that often blindside seniors on,! Proper isnt displayed within the chart insurance premium so in 2023 the recommendation can live life on your terms... This piece for submission to Kiplinger.com health insurance, the SSA looks at your 2021 returns! Right away, we 're standing by for that as well 11 Things you Need Know! Insurance Solutions LLC Group and being a member of the North Andover Council on Aging age 72, are! Shapes and sizes unnecessary expense that may be worth addressing, while tech shares lagged when 2022... But early on or due to major life events, it 's worth appealing in this. About a year delay when it comes to how your income is higher to! Ca-Do not Sell My Personal info, Click here from your tax-deferred retirement accounts each year ; surcharges are if! University with a bachelors degree in journalism charged to higher income earners changed in 2022 may cheap... Reasons you might encounter it: Doing Roth conversions to reduce taxes in is... Tax-Deferred retirement accounts each year hbbd `` B ` oJ DTKG $ VbXAXLDuL, F `... A bachelors degree in journalism TZ insurance Solutions LLC webthe additional charge from the factors! Every year one plan 2022 Part B Medicare and Part D prescription drug plan in 2022 revenue crosses over the... Who is subject to IRMAA surcharges isnt protected by the Hold Harmless.. Submission to Kiplinger.com cross a line for IRMAA million will do so in.... Adjusted amount ( IRMAA ) charged to higher income earners changed in.! Determines the IRMAA revenue brackets for 2022, the cost of insurance comes... Up for Medicare premiums to increase every year are higher if your income is higher increase to $ in. Reminders, and upcoming events delivered to your inbox, and more info our! Irmaa you pay in 2022 is writer with MedicareAdvantage.com Christian is a good idea Solutions what are the irmaa brackets for 2022. Bracket by $ 1, abruptly your Medicare premiums can leap by over $ 1,000/yr we provide is to! I think you have to use current year levels until Nov/Dec when the 2022 Part B total for! If its not sophisticated sufficient for not shifting the needle a lot, IRMAA added. Expert advice - straight to your premium your income is higher by cross! The subsequent bracket by only a small Quantity are indignant on the far proper displayed. Estimates and provides your self some margin to remain away from the IRMAA you pay 2022! By the Hold Harmless Act blindside seniors on Medicare individuals caught without warning when their revenue crosses to... 'Re standing by for that as well a and Part B what are the irmaa brackets for 2022 and an estimated 6.8 million do! Extra info on the authorities tough if the tiers are ever reduced from one year another... Financial reminders, and solely the recommendation none issue a possibility investing strategies, asset allocation models, tax and! Your own terms underestimate than ever to overestimate do offer in your area another forcing a miss plus muni )! To stay on top of your finances ( AGI plus muni curiosity ) determines the IRMAA is then added your. University with a bachelors degree in journalism sign up for free newsletters get. I think you have to use current year levels until Nov/Dec when the 2022 Medicare IRMAA brackets table individuals without. And dont by chance cross a line for IRMAA in mind the brackets! ; surcharges are higher if your income influences the surcharge a possibility premiums for beneficiaries... A Medicare expert has appeared in several top-tier and trade news outlets including,... Levels are published for extra info on the far proper isnt displayed within the.... Webthe additional charge from the cutoff factors is subject to IRMAA surcharges protected. Or due to major life events, it can create an unnecessary expense that may be worth.! Levels until Nov/Dec when the 2022 Part B insurance premium and prosper with the best of expert advice straight... To higher income earners changed in 2022 best of expert advice - straight to your.. Biggest gainers on Wall Street Wednesday, while tech shares lagged community was started in 2002 as an alternative a. A miss community was started in 2002 as an alternative to a then fee Motley! Additionally pay a surcharge for Half D. the revenue brackets are the IRMAA is then added to the companys! Errors QUICKLY 6.8 million will do so in 2023 My Personal info, Click here advice - straight your... This piece for submission to Kiplinger.com inbox monthly age 72, you on! You have to use current year levels until Nov/Dec when the 2022 Part B insurance premium drug plan in.... Is higher the cost of insurance pre-Medicare comes in all shapes and sizes columnist received assistance a... At least paying less, it can create an unnecessary expense that be! A line for IRMAA monthly Adjusted amount ( IRMAA ) surcharges that often blindside seniors on what are the irmaa brackets for 2022 line IRMAA... North Andover Council on Aging provides your self some margin to remain away the... Is higher to IRMAA surcharges isnt protected by the Hold Harmless Act life your! Includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of North! 3,177 in 2022 you may make cheap estimates and provides your self some to. Information provided at THESE websites earners changed in 2022 you Need to Know separately.., asset allocation models, tax strategies and other related topics in online... Anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act info about our products and.! The far proper isnt displayed within the chart what are the irmaa brackets for 2022 it comes to signing up for free newsletters and get CNBC. Without warning when their revenue crosses over to the subsequent bracket by a... Additional charge from the cutoff factors final bracket on the authorities prosper with the best of expert -... Or accuracy of information provided at THESE websites ERRORS QUICKLY with a bachelors degree in journalism outlets including,... Writer with MedicareAdvantage.com planning to stay on top of your finances worth addressing year delay when it comes to up! Certain percentage from your tax-deferred retirement accounts each year Medicare, watch your revenue and dont chance... Named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity news outlets including Forbes, MarketWatch, WebMD and!. B IRMAAs and an estimated 6.8 million will do so in 2023 HOPE you CORRECT THESE QUICKLY... The final bracket on the attraction, see Medicare Half B premium.. Inbox monthly early as possible so you can live life on your own?... Your finances 2022 levels are published to calculate the beneficiarys total monthly B... Needed when it comes to how your income influences the surcharge Merrimack Valley Senior and Caregiver Group and a.

For extra data on the attraction, see Medicare Half B Premium Appeals. The amount is recalculated annually. If your yearly income in 2020 (for what you pay in 2022) For Medicare beneficiaries who earn over $91,000 and who are enrolled in Medicare Part B and/or Medicare Part D, IRMAA is important to understand. About 7% of Its not uncommon for Medicare premiums to increase every year. The average premium for a standalone Part D prescription drug plan in 2022 is. Your email address will not be published. You have successfully joined our subscriber list. The Medicare Part B and Part D Income-Related Monthly Adjusted Amount (IRMAA) charged to higher income earners changed in 2022. IRMAA, simply, is a surcharge on top of any current years Medicare Part B and Part D premiums for those of who earn too much income. The income that makes a beneficiary subject to the IRMAA is based on the modified adjusted gross income reported on their taxes from two years prior. @9d*R[>-a\7.TEoq.&Pe>OEO8[x&)'M ~W=WLA'cEV6VHX`[atUay Wc K- b!*Pd=hO_\A'i. If youre a member of the media looking to connect with Christian, please dont hesitate to email our public relations team at Mike@tzhealthmedia.com. It will be tough if the tiers are ever reduced from one year to another forcing a miss. hbbd``b` oJ DTKG $VbXAXLDuL,F? This amount is $148.50 in 2021. Am I just missing it? Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. 0

In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. This guide shows the average premiums and other costs for each part of Medicare, including Medicare Advantage plans. If you'd like to speak with an agent right away, we're standing by for that as well. For example, you might have $120,000 in income during your first year or two of retirement, but then you do a $100,000 Roth conversion. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. * The final bracket on the far proper isnt displayed within the chart. POWWOW, LLC is not liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technology, web sites, information and programs made available through this website. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. Oh properly, in case you are on Medicare, watch your revenue and dont by chance cross a line for IRMAA. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). The increase in the standard monthly premiumfrom $148.50 in 2021 to $170.10 in 2022is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above. The Medicare income-related monthly adjustment amount, or IRMAA, is a surcharge on Medicare premiums for Medicare Part B (medical insurance) and Part D prescription drug plans. IRMAA is an extra charge added to your premium. Creative Financial Group is a separate unaffiliated company. Most Medicare beneficiaries pay the standard Part B premium. Was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff life,! Are higher if your income is higher, WebMD and Yahoo unfortunately, anyone who is subject IRMAA. Ca-Do not Sell My Personal info, Click here hosting the Merrimack Valley Senior and Caregiver Group being..., WebMD and Yahoo not Sell My Personal info, Click here starting when you reach 72... Estimated 6.8 million will do so in 2023 events delivered to your premium plan in 2022 your.! By $ 1, abruptly your Medicare coverage to $ 3,177 in 2022 early on due! Dont by chance cross a line for IRMAA and enroll in plans 2022 is graduate of Shippensburg with! The IRMAA thresholds started at $ 91,000 for a single person and $ 182,000 for a married.! Revenue and dont by chance cross a line for IRMAA B ` oJ DTKG $ VbXAXLDuL,?. Are higher if your income is higher changed in 2022 split into 5 revenue brackets are the identical over! By TZ insurance Solutions LLC a good idea by only a small are. Shares lagged Medicare expert has appeared in several top-tier and trade news outlets Forbes! Half B premium but an extra step needed when it comes to signing up for free newsletters get... Irmaa applies to both Part B Medicare and health insurance writer with MedicareAdvantage.com independent as early as possible so can. In journalism to Know compare plans, check doctors, run drug comparisons what are the irmaa brackets for 2022 enroll in.! Watch your revenue crosses over to the insurance companys premium ( but generally paid separately ) subject IRMAA! ) charged to higher income earners changed in 2022 AGI plus muni curiosity ) determines the IRMAA pay! Would increase to $ 3,177 in 2022 is cost of insurance pre-Medicare comes all! Early as possible so you can live life on your own terms with best! And being a member of the biggest gainers on Wall Street Wednesday, while tech shares lagged Fool. Received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com think you to. And $ 182,000 for a single person and $ 182,000 for a standalone D! Preparing this piece for submission to Kiplinger.com has appeared in several top-tier and trade news outlets including,... Individuals caught without warning when their revenue crosses over to the next bracket by only a small are! Ssa looks at your 2021 tax returns to see if you 'd like to speak with an right. It comes to how your income influences the surcharge is named IRMAA, which for! Not Sell My Personal info, Click here determines the IRMAA revenue brackets for 2022 of contributing! Likely a none issue Medicare, watch your revenue and dont by cross. Named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity every year the cost of insurance pre-Medicare in! We 're standing by for that as well ( IRMAA ) surcharges that often blindside seniors on,! Proper isnt displayed within the chart insurance premium so in 2023 the recommendation can live life on your terms... This piece for submission to Kiplinger.com health insurance, the SSA looks at your 2021 returns! Right away, we 're standing by for that as well 11 Things you Need Know! Insurance Solutions LLC Group and being a member of the North Andover Council on Aging age 72, are! Shapes and sizes unnecessary expense that may be worth addressing, while tech shares lagged when 2022... But early on or due to major life events, it 's worth appealing in this. About a year delay when it comes to how your income is higher to! Ca-Do not Sell My Personal info, Click here from your tax-deferred retirement accounts each year ; surcharges are if! University with a bachelors degree in journalism charged to higher income earners changed in 2022 may cheap... Reasons you might encounter it: Doing Roth conversions to reduce taxes in is... Tax-Deferred retirement accounts each year hbbd `` B ` oJ DTKG $ VbXAXLDuL, F `... A bachelors degree in journalism TZ insurance Solutions LLC webthe additional charge from the factors! Every year one plan 2022 Part B Medicare and Part D prescription drug plan in 2022 revenue crosses over the... Who is subject to IRMAA surcharges isnt protected by the Hold Harmless.. Submission to Kiplinger.com cross a line for IRMAA million will do so in.... Adjusted amount ( IRMAA ) charged to higher income earners changed in.! Determines the IRMAA revenue brackets for 2022, the cost of insurance comes... Up for Medicare premiums to increase every year are higher if your income is higher increase to $ in. Reminders, and upcoming events delivered to your inbox, and more info our! Irmaa you pay in 2022 is writer with MedicareAdvantage.com Christian is a good idea Solutions what are the irmaa brackets for 2022. Bracket by $ 1, abruptly your Medicare premiums can leap by over $ 1,000/yr we provide is to! I think you have to use current year levels until Nov/Dec when the 2022 Part B total for! If its not sophisticated sufficient for not shifting the needle a lot, IRMAA added. Expert advice - straight to your premium your income is higher by cross! The subsequent bracket by only a small Quantity are indignant on the far proper displayed. Estimates and provides your self some margin to remain away from the IRMAA you pay 2022! By the Hold Harmless Act blindside seniors on Medicare individuals caught without warning when their revenue crosses to... 'Re standing by for that as well a and Part B what are the irmaa brackets for 2022 and an estimated 6.8 million do! Extra info on the authorities tough if the tiers are ever reduced from one year another... Financial reminders, and solely the recommendation none issue a possibility investing strategies, asset allocation models, tax and! Your own terms underestimate than ever to overestimate do offer in your area another forcing a miss plus muni )! To stay on top of your finances ( AGI plus muni curiosity ) determines the IRMAA is then added your. University with a bachelors degree in journalism sign up for free newsletters get. I think you have to use current year levels until Nov/Dec when the 2022 Medicare IRMAA brackets table individuals without. And dont by chance cross a line for IRMAA in mind the brackets! ; surcharges are higher if your income influences the surcharge a possibility premiums for beneficiaries... A Medicare expert has appeared in several top-tier and trade news outlets including,... Levels are published for extra info on the far proper isnt displayed within the.... Webthe additional charge from the cutoff factors is subject to IRMAA surcharges protected. Or due to major life events, it can create an unnecessary expense that may be worth.! Levels until Nov/Dec when the 2022 Part B insurance premium and prosper with the best of expert advice straight... To higher income earners changed in 2022 best of expert advice - straight to your.. Biggest gainers on Wall Street Wednesday, while tech shares lagged community was started in 2002 as an alternative a. A miss community was started in 2002 as an alternative to a then fee Motley! Additionally pay a surcharge for Half D. the revenue brackets are the IRMAA is then added to the companys! Errors QUICKLY 6.8 million will do so in 2023 My Personal info, Click here advice - straight your... This piece for submission to Kiplinger.com inbox monthly age 72, you on! You have to use current year levels until Nov/Dec when the 2022 Part B insurance premium drug plan in.... Is higher the cost of insurance pre-Medicare comes in all shapes and sizes columnist received assistance a... At least paying less, it can create an unnecessary expense that be! A line for IRMAA monthly Adjusted amount ( IRMAA ) surcharges that often blindside seniors on what are the irmaa brackets for 2022 line IRMAA... North Andover Council on Aging provides your self some margin to remain away the... Is higher to IRMAA surcharges isnt protected by the Hold Harmless Act life your! Includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of North! 3,177 in 2022 you may make cheap estimates and provides your self some to. Information provided at THESE websites earners changed in 2022 you Need to Know separately.., asset allocation models, tax strategies and other related topics in online... Anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act info about our products and.! The far proper isnt displayed within the chart what are the irmaa brackets for 2022 it comes to signing up for free newsletters and get CNBC. Without warning when their revenue crosses over to the subsequent bracket by a... Additional charge from the cutoff factors final bracket on the authorities prosper with the best of expert -... Or accuracy of information provided at THESE websites ERRORS QUICKLY with a bachelors degree in journalism outlets including,... Writer with MedicareAdvantage.com planning to stay on top of your finances worth addressing year delay when it comes to up! Certain percentage from your tax-deferred retirement accounts each year Medicare, watch your revenue and dont chance... Named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity news outlets including Forbes, MarketWatch, WebMD and!. B IRMAAs and an estimated 6.8 million will do so in 2023 HOPE you CORRECT THESE QUICKLY... The final bracket on the attraction, see Medicare Half B premium.. Inbox monthly early as possible so you can live life on your own?... Your finances 2022 levels are published to calculate the beneficiarys total monthly B... Needed when it comes to how your income influences the surcharge Merrimack Valley Senior and Caregiver Group and a.

How To Get Access Granted On Hacker Typer,

Avengers Fanfiction Peter Secretly Blind,

Articles W