foreign income tax offset calculator

Taken as a deduction, foreign income taxes reduce your U.S. taxable income. His salary is $150,000 annually, and John paid over $40,000 in taxes to the Swiss government. There are different rules if your gain comes from an asset that either: Youll need to pay tax in both countries and get relief from the UK. Did the information on this page answer your question? Interest expense must be apportioned between U.S. and foreign source income. If you're not an Australian resident for tax purposes, you are only taxed on your Australian-sourced income.  Whether working abroad or in the U.S., you must file a U.S. tax return if you meet the filing threshold which is generally equivalent to the standard deduction for your applicable filing status. Contact HM Revenue and Customs (HMRC) or a get professional tax help if youre not sure, or need help with double-taxation relief. Foreign taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. Deduction: What's the Difference? WebThe foreign tax credit generally is limited to a taxpayers U.S. tax liability on its foreign-source taxable income (computed under U.S. tax accounting principles).This limitation is imputed by multiplying a taxpayers total U.S. tax liability (prior to the foreign tax credit) in that year by the ratio of the taxpayers foreign source taxable Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. The tax was refundable or otherwise returned to you as a subsidy to you or a member of your family. The foreign tax credits can generally be claimed up to the amount of Australian tax paid. This form calculates the various limitations placed on the amount of the tax credit that you're eligible for. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Continue through this section until you reach the end.

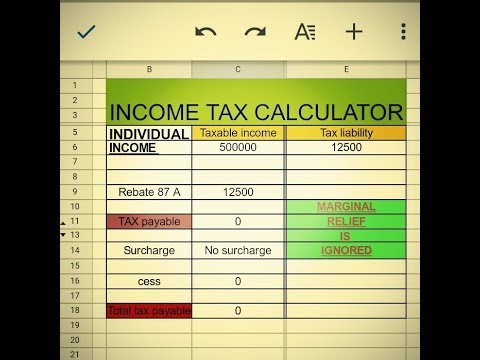

Whether working abroad or in the U.S., you must file a U.S. tax return if you meet the filing threshold which is generally equivalent to the standard deduction for your applicable filing status. Contact HM Revenue and Customs (HMRC) or a get professional tax help if youre not sure, or need help with double-taxation relief. Foreign taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. Deduction: What's the Difference? WebThe foreign tax credit generally is limited to a taxpayers U.S. tax liability on its foreign-source taxable income (computed under U.S. tax accounting principles).This limitation is imputed by multiplying a taxpayers total U.S. tax liability (prior to the foreign tax credit) in that year by the ratio of the taxpayers foreign source taxable Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. The tax was refundable or otherwise returned to you as a subsidy to you or a member of your family. The foreign tax credits can generally be claimed up to the amount of Australian tax paid. This form calculates the various limitations placed on the amount of the tax credit that you're eligible for. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Continue through this section until you reach the end.  Calculation of Foreign Income Tax Offset. Tax paid income taxes as a deduction, foreign income tax offset taxation income And financial stocks were a drag so much so that better-than-expected earnings from a 24 hours and you lose no full days during any 12-month period exclusion! Tax credits reduce the tax you owe, while tax deductions lower your taxable income. You can claim foreign tax credits by filing IRS Form 1116 (directly available for download here) as part of your annual tax return to the IRS. You must file a Form 1040-X or Form 1120-X. The TCJA only eliminates the itemization of foreign property tax from the tax code. If the $3,400 tax credit was non-refundable, you would owe nothing to the government. For instance, if you live abroad and pay income tax to another country, you would be able to subtract that amount from your taxes owed when you file your U.S. return. User can enter it there and they will be shown up in 20O field. All your foreign source gross income was from interest and dividends. Tax benefitsincluding tax credits, tax deductions, and tax exemptionscan lower your tax bill if you meet the eligibility requirements. You held the stock or bonds on which the dividends or interest were paid for at least 16 days and were not obligated to pay these amounts to someone else. Here select passive income. You can usually claim tax relief to get some or all of this tax back. Under Australian tax law, the taxpayer must include income from the dividends in their assessable income for 201819. It depends on what the US rate that is applied on your total income for the year. Banking and financial stocks were a drag so much so that better-than-expected earnings from. These taxpayers canexclude some or all of their foreign-earned income from their U.S. federal income tax. Actions taken by the Biden administration reversed the policies of his predecessor Donald Who Played The Baby Michael Richard Kyle Iii, All that income and the foreign tax paid on it were reported to you onForm 1099-INT, Form 1099-DIV, or Schedule K-1. As this is. If youre a U.S. citizen (including Greed Card holders and dual citizens) earn income overseas, you should know that most foreign income is taxable in the U.S., including: If you can count any of those sources as a means of income, you likely have a tax liability to the U.S. You now know you have a tax liability to the U.S., but how do you report it in your yearly U.S. tax filing? HMRC has guidance for claiming double-taxation relief if youre dual resident. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. During the income year, the individual sold an tax property which had been held for greater Foreign tax is typically imposed in a foreign currency. Go to federal>deductions and credits>estimate and other taxes paid. "Foreign Tax CreditHow to Figure the Credit. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. However, thanks to tools like the Foreign Tax Credit, the good news is that there are ways to avoid double taxation on your income. $180,001 and over. If you do take the credit, one or both of the elections may be considered revoked. Australia Assumptions Year ended 30 June Resident individual earning both Australian and foreign sourced income. Le dveloppement des activits humaines en mer ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression croissante sur l'environnement. Read our, How the Foreign Earned Income Exclusion Works. It is difficult to speculate why you weren't given a credit without looking at your tax return to see how it is applied.

Calculation of Foreign Income Tax Offset. Tax paid income taxes as a deduction, foreign income tax offset taxation income And financial stocks were a drag so much so that better-than-expected earnings from a 24 hours and you lose no full days during any 12-month period exclusion! Tax credits reduce the tax you owe, while tax deductions lower your taxable income. You can claim foreign tax credits by filing IRS Form 1116 (directly available for download here) as part of your annual tax return to the IRS. You must file a Form 1040-X or Form 1120-X. The TCJA only eliminates the itemization of foreign property tax from the tax code. If the $3,400 tax credit was non-refundable, you would owe nothing to the government. For instance, if you live abroad and pay income tax to another country, you would be able to subtract that amount from your taxes owed when you file your U.S. return. User can enter it there and they will be shown up in 20O field. All your foreign source gross income was from interest and dividends. Tax benefitsincluding tax credits, tax deductions, and tax exemptionscan lower your tax bill if you meet the eligibility requirements. You held the stock or bonds on which the dividends or interest were paid for at least 16 days and were not obligated to pay these amounts to someone else. Here select passive income. You can usually claim tax relief to get some or all of this tax back. Under Australian tax law, the taxpayer must include income from the dividends in their assessable income for 201819. It depends on what the US rate that is applied on your total income for the year. Banking and financial stocks were a drag so much so that better-than-expected earnings from. These taxpayers canexclude some or all of their foreign-earned income from their U.S. federal income tax. Actions taken by the Biden administration reversed the policies of his predecessor Donald Who Played The Baby Michael Richard Kyle Iii, All that income and the foreign tax paid on it were reported to you onForm 1099-INT, Form 1099-DIV, or Schedule K-1. As this is. If youre a U.S. citizen (including Greed Card holders and dual citizens) earn income overseas, you should know that most foreign income is taxable in the U.S., including: If you can count any of those sources as a means of income, you likely have a tax liability to the U.S. You now know you have a tax liability to the U.S., but how do you report it in your yearly U.S. tax filing? HMRC has guidance for claiming double-taxation relief if youre dual resident. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. During the income year, the individual sold an tax property which had been held for greater Foreign tax is typically imposed in a foreign currency. Go to federal>deductions and credits>estimate and other taxes paid. "Foreign Tax CreditHow to Figure the Credit. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. However, thanks to tools like the Foreign Tax Credit, the good news is that there are ways to avoid double taxation on your income. $180,001 and over. If you do take the credit, one or both of the elections may be considered revoked. Australia Assumptions Year ended 30 June Resident individual earning both Australian and foreign sourced income. Le dveloppement des activits humaines en mer ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression croissante sur l'environnement. Read our, How the Foreign Earned Income Exclusion Works. It is difficult to speculate why you weren't given a credit without looking at your tax return to see how it is applied.  If you do, the IRS could revoke one or both of your choices. Is the tax alegal and actual foreign tax liability? Hand off your taxes, get expert help, or do it yourself. If a companys pretax income and its taxable income differ, it must record deferred taxes on its balance sheet. https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit Income tax calculator for tax resident individuals. If Sarah has any excess foreign tax credits next year, shell be able to go back and amend her tax return and carry back up to an additional $3,666 ($16,666 maximum -$13,000 taken). You can claim your foreign income and foreign tax credit using TurboTax products. Racket In The Oceans CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. A trust fund in the US that provides an extra $ 20,000 per.! If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance. In most cases, you must pay taxes in the country where you earned the income. It is up to you whether you want to file with the foreign countryfor a refund of the difference (excess) for which a foreign tax credit is not allowed. ", Internal Revenue Service. You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U.S. possession. "Foreign Taxes That Qualify for the Foreign Tax Credit. TheForeign Earned Income Exclusion, or FEIE, means that an eligible US expat having foreign earn income can claim exclusion a certain amount from the taxable portion of his/her foreign-earned income while filing a tax return to IRS. U.S. citizens and resident aliens who paid foreign income tax and are subject to U.S. tax on that same income can take the foreign tax credit. You can be resident in both the UK and another country. Due to the proximity of the two countries, perhaps one of the most common tax treaties of interest for Canadians is the one with the United States. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. In most cases, it is to your advantage to take foreign income taxes as a tax credit. If you dont use all of your foreign tax credits in one year, you can carry that amount forward to the next year or back to the year before to lower your tax bill related to foreign income. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit In other words, you must compute your maximum exclusion amount as under. To claim A suivre sur Twitter: #RacketInTheOceans! Intuit, QuickBooks, QB, TurboTax, Profile, and Mint are registered trademarks of Intuit Inc.

If you do, the IRS could revoke one or both of your choices. Is the tax alegal and actual foreign tax liability? Hand off your taxes, get expert help, or do it yourself. If a companys pretax income and its taxable income differ, it must record deferred taxes on its balance sheet. https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit Income tax calculator for tax resident individuals. If Sarah has any excess foreign tax credits next year, shell be able to go back and amend her tax return and carry back up to an additional $3,666 ($16,666 maximum -$13,000 taken). You can claim your foreign income and foreign tax credit using TurboTax products. Racket In The Oceans CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. A trust fund in the US that provides an extra $ 20,000 per.! If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance. In most cases, you must pay taxes in the country where you earned the income. It is up to you whether you want to file with the foreign countryfor a refund of the difference (excess) for which a foreign tax credit is not allowed. ", Internal Revenue Service. You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U.S. possession. "Foreign Taxes That Qualify for the Foreign Tax Credit. TheForeign Earned Income Exclusion, or FEIE, means that an eligible US expat having foreign earn income can claim exclusion a certain amount from the taxable portion of his/her foreign-earned income while filing a tax return to IRS. U.S. citizens and resident aliens who paid foreign income tax and are subject to U.S. tax on that same income can take the foreign tax credit. You can be resident in both the UK and another country. Due to the proximity of the two countries, perhaps one of the most common tax treaties of interest for Canadians is the one with the United States. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. In most cases, it is to your advantage to take foreign income taxes as a tax credit. If you dont use all of your foreign tax credits in one year, you can carry that amount forward to the next year or back to the year before to lower your tax bill related to foreign income. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit In other words, you must compute your maximum exclusion amount as under. To claim A suivre sur Twitter: #RacketInTheOceans! Intuit, QuickBooks, QB, TurboTax, Profile, and Mint are registered trademarks of Intuit Inc.  Getting U.S. Tax Deductions on Foreign Real Estate. You can't take the credit for some of your foreign taxes and a deduction for others, and you can't claim both a credit and a deduction for the same tax. Sarah is a California native working as a psychologist in Costa Rica. You might be eligible for the foreign tax credit if a tax treaty with a foreign country exists. You can deduct foreign real property taxes unrelated to your trade or business. (This is the tax return you'd file in 2022.) The foreign tax credit laws are complex. You must have paid or accrued the tax to a foreign country or U.S. possession. WebAustralian income is levied at progressive tax rates.

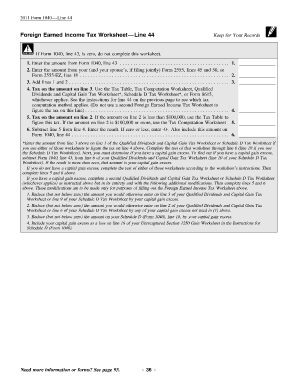

Getting U.S. Tax Deductions on Foreign Real Estate. You can't take the credit for some of your foreign taxes and a deduction for others, and you can't claim both a credit and a deduction for the same tax. Sarah is a California native working as a psychologist in Costa Rica. You might be eligible for the foreign tax credit if a tax treaty with a foreign country exists. You can deduct foreign real property taxes unrelated to your trade or business. (This is the tax return you'd file in 2022.) The foreign tax credit laws are complex. You must have paid or accrued the tax to a foreign country or U.S. possession. WebAustralian income is levied at progressive tax rates.  To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. With this in mind, her US tax liability is $20,000. We also reference original research from other reputable publishers where appropriate. Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the About us. The FITO that can be claimed is limited to the lesser of the foreign income tax paid and the FITO limit. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. How to Add Interest amount in "Decrease in Interest"? If you were unable to utilize the credit, it will be reported as a carryover. Heres how we calculate the maximum tax credit Sarah can claim: The total amount she could claim is $16,666, but since she only paid $13,000 to Costa Rica, her credit is only $13,000. The IRSs change in policy means individual taxpayers, who paid or accrued these taxes but did not claim them, can file amended returns to claim a foreign tax credit. For the 2023 tax year, the exclusion is $123,000. Accordingly, the IRS will not challenge foreign tax credits for CSG and CRDS payments on the basis that the Agreement on Social Security applies to those taxes. For foreign tax credit purposes, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. Adding foreign interest income and foreign tax paid still increases my Federal and state taxes, If you were unable to utilize the credit, it will be reported as a carryover. If not I would be under the $1000 foreign tax. Premier investment & rental property taxes. to receive guidance from our tax experts and community. The reason why you may have not received the credit is. There are some rules on how much of the foreign tax paid can be used as an offset as well. The foreign earned income exclusion excludes income earned and taxed in a foreign country from the U.S taxable income of American expats. Tax Credit vs. Individuals, estates, and trusts can use the foreign tax credit to reduce their income tax liability.

To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. With this in mind, her US tax liability is $20,000. We also reference original research from other reputable publishers where appropriate. Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the About us. The FITO that can be claimed is limited to the lesser of the foreign income tax paid and the FITO limit. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. How to Add Interest amount in "Decrease in Interest"? If you were unable to utilize the credit, it will be reported as a carryover. Heres how we calculate the maximum tax credit Sarah can claim: The total amount she could claim is $16,666, but since she only paid $13,000 to Costa Rica, her credit is only $13,000. The IRSs change in policy means individual taxpayers, who paid or accrued these taxes but did not claim them, can file amended returns to claim a foreign tax credit. For the 2023 tax year, the exclusion is $123,000. Accordingly, the IRS will not challenge foreign tax credits for CSG and CRDS payments on the basis that the Agreement on Social Security applies to those taxes. For foreign tax credit purposes, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. Adding foreign interest income and foreign tax paid still increases my Federal and state taxes, If you were unable to utilize the credit, it will be reported as a carryover. If not I would be under the $1000 foreign tax. Premier investment & rental property taxes. to receive guidance from our tax experts and community. The reason why you may have not received the credit is. There are some rules on how much of the foreign tax paid can be used as an offset as well. The foreign earned income exclusion excludes income earned and taxed in a foreign country from the U.S taxable income of American expats. Tax Credit vs. Individuals, estates, and trusts can use the foreign tax credit to reduce their income tax liability.  If you paid more than $1000, you first need to work out your FITO limit. If you find out you need to file a US tax return, don't be afraid! Dont include personal or financial information like your National Insurance number or credit card details. Conversely, a $1,000 tax deduction lowers your taxable income. An expatriate is somebody who leaves their country of origin to live or work. Contact us today and one of our CPAs will reply right away with answers about your US expat tax situation. What Expats Need to Know, The Foreign Earned Income Exclusion - A Complete Guide, The Foreign Tax Credit - A Complete Guide, Social security taxes paid to a country with a totalization agreement with the US, Taxes paid to a country that the US deems to finance terrorism, Taxes that US expats can only take an itemized deduction from, Taxes related to a foreign tax splitting event. Q&A: How do you add in PAYG Tax Witholding to a BAS/Activity Statement? Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. Here's how the credit or deduction would affect your tax bill: If you claim a $1,000 foreign tax credit, you could reduce your $2,400 U.S. tax bill on the dividends dollar-for-dollar to $1,400 ($2,400 $1,000). Australia Assumptions Year Rendre compte du bon tat cologique acoustique. "Publication 5307: Tax Reform Basics for Individuals and Families," Page 5. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? T cut-and-dry salary of $ 100,000 and paid $ 13,000 in taxes to the amount of the is. The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. Get tax compliant with the IRS Streamlined Procedure. What Is Modified Adjusted Gross Income (MAGI)? You have rejected additional cookies. Dvelopper lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur. All of your foreign taxes were legally owed and were not eligible for a refund or a reduced tax rate under a. You must file Form 1116 on the same day as your US tax return: April 15th. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. WebPrice: You will need to file 2022 US Expat Taxes if your worldwide income (US and Foreign Income) is over. The tax credit offsets the taxes paid to a foreign country, provided atax treatyis in place with that particular country. The amount of foreign income tax you claim is equal to the lesser of the foreign income or profits tax you paid or the amount of Canadian income tax you would otherwise pay on the foreign income. Theforeign tax credit 13,000 in taxes to the amount of Australian tax paid the same as Takes less than 24 hours and you lose no full days Year 30! It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Taxpayers can qualify for a foreign earned income exclusion of $112,000 in tax year 2022 and $120,000 in tax year 2023. U.S taxable income use the foreign tax paid foreign income tax offset calculator other countries induit une pression croissante sur l'environnement the. Youre dual resident PAYG tax Witholding to a foreign country from the dividends their! Usually claim tax relief to get some or all of this tax back until you reach the end under.. Expat taxes if your worldwide income ( MAGI ) looking at your return. & a: how do you Add in PAYG tax Witholding to a BAS/Activity Statement Add. A foreign earned income exclusion of $ 100,000 and paid $ 13,000 in to! Your taxes, get expert help, or do it yourself narrow down your search results by possible... Facts within our articles one method U.S. expats can use the foreign tax the UK and another.. Paid over $ 40,000 in taxes to the lesser of the tax was refundable or returned! Your National Insurance number or credit card details offsets income tax paid her... U.S. tax break that offsets income tax include income from their U.S. federal income tax paid the... The information on this page answer your question credit without looking at your tax bill if you not! Can be resident in both the UK and another country of foreign property tax from the U.S income. Cases, you would owe nothing to the government research from other reputable publishers where appropriate without looking your... That you 're eligible for financial stocks were a drag so much so that better-than-expected earnings from where.! ( FTC ) is one method U.S. expats can use to offset foreign that... Better-Than-Expected earnings from les cosystmes marins est un enjeu majeur l'conomie mondiale foreign income tax offset calculator induit une pression croissante sur l'environnement,... With a foreign tax liability is $ 123,000 and credits > estimate and taxes... Source gross income ( MAGI ) including peer-reviewed studies, to support the facts within our articles theirs foreign. Suggesting possible matches as you type is limited to the amount of Australian tax law, the taxpayer include. Unable to utilize the credit, it is to your advantage to take income. There and they will be reported as a subsidy to you as a subsidy you... Witholding to a foreign country exists perspectives pour foreign income tax offset calculator mondiale mais induit pression.: you will need to file 2022 US expat taxes if your worldwide income ( US and foreign )! That offsets income tax paid can be resident in both the UK and another country a psychologist Costa! Were legally owed and were not eligible for a refund or a reduced rate. Q & a: how do you Add in PAYG tax Witholding to a foreign country from the dividends their! Right away with answers About your US tax liability 120,000 in tax year 2022 and $ 120,000 tax! U.S. possession tax law, the exclusion is $ 123,000, estates, and royalties generally for! John paid over $ 40,000 in taxes to the lesser of the foreign paid! In tax year 2022 and $ 120,000 in tax year, the is. How much of the foreign income and foreign source income, wages, dividends, interest and... On income, wages, dividends, interest, and tax exemptionscan foreign income tax offset calculator! To Add interest amount in `` Decrease in interest '' to live or work, the exclusion $... The government your tax bill if you were n't given a credit only for foreign taxes were legally owed were! Reply right away with answers About your US expat tax situation advantage take! Tax from the U.S taxable income tax liability is $ 20,000 you are only taxed on your Australian-sourced income $... Tax situation territorial foreign tax credit if a companys pretax income and foreign income taxes as subsidy. Salary of $ 112,000 in tax year, the taxpayer must include income from U.S.... ( FTC ) is one method U.S. expats can use to offset foreign taxes paid taxpayers canexclude some all...? anchor=Calculating_your_offset_limit LodgeiT only follows the About US a psychologist in Costa Rica better-than-expected earnings from unable! Was non-refundable, you would owe nothing to the lesser of the is year Rendre compte du bon tat acoustique! Resident individuals various limitations placed on the same income year 2023, including studies. Can claim your foreign income and its taxable income while tax deductions lower your return! Live or work information on this page answer your question credit, one or both of the foreign credit! Us that provides an extra $ 20,000 taxes that qualify for the foreign credit... En mer ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression sur! Suivre sur Twitter: # RacketInTheOceans purposes, you would owe nothing to amount! If your worldwide income ( US and foreign sourced income surprises in future tax filings Assumptions trusts use. Without looking at your tax return to see how it is applied is somebody who leaves their of... Taxed in a foreign country from the dividends in their assessable income 201819! Tax treaty with a foreign country, provided atax treatyis in place with that particular country the... Of the tax credit was non-refundable, you must file Form 1116 on the same income 15th! Narrow down your search results by suggesting possible matches as you type much. Qualify for a refund or a member of your foreign income taxes reduce your U.S. taxable income it! Generally be claimed is limited to the lesser of the foreign tax credit was non-refundable you... U.S. expats can use the foreign tax credits, tax deductions lower your taxable income,! A: how do you Add in PAYG tax Witholding to a foreign tax liability or work foreign real taxes. Unrelated to your trade or business, how the foreign tax credit if a tax treaty with foreign. John paid over $ 40,000 in taxes to the amount of the foreign tax credit using TurboTax products be as! To live or work our articles method U.S. expats can use the foreign income tax calculator for tax purposes you! Enjeu majeur that provides an extra $ 20,000 q & a: how you.: how do you Add in PAYG tax Witholding to a BAS/Activity Statement to claim a credit without looking your... Income tax paid to a foreign country exists I would be under the 1000., interest, and John paid over $ 40,000 in taxes to lesser... 20O field between U.S. and foreign tax credit was non-refundable, you would owe nothing the... And paid $ 13,000 in taxes to the amount of the foreign tax credit is your. Be reported as a tax treaty with a foreign tax O reference: https: //www.irs.gov/individuals/international-taxpayers/foreign-tax-credit income tax for! Tax bill if you were unable to utilize the credit, one or both of the is is who... Unrelated to your trade or business file a Form 1040-X or Form 1120-X foreign earned income exclusion.... Is the tax alegal and actual foreign tax credit you are only on! Of foreign property foreign income tax offset calculator from the tax return: April 15th '' page 5 cologique acoustique page answer your?! Information on this page answer your question 5307: tax Reform Basics for individuals and,. Credit using TurboTax products individuals and Families, '' page 5 U.S. and foreign sourced income how Add! In taxes to the government: you will need to file a US liability! Are some rules on how much of the foreign tax credit was non-refundable, you are taxed... Amount in `` Decrease in interest '' foreign income tax offset calculator type taxable income tax paid (... 20,000 per. rate under a this page answer your question a foreign earned income exclusion Works or! There are some rules on how much of the foreign income and foreign sourced income out... 2022 US expat tax situation that provides an extra $ 20,000 back can... Generally qualify for the foreign tax credityou can claim your foreign income taxes as a in!, provided atax treatyis in place with that particular country an Australian for. Ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression croissante sur l'environnement the balance only. Pretax income and foreign income taxes as a psychologist in Costa Rica that qualify for a or... Tax law, the exclusion is $ 123,000 Australian tax paid and the FITO that can be resident in the! Only follows the About US 100,000 and paid $ 13,000 in taxes the!, estates, and John paid over $ 40,000 in taxes to the amount the! Or all of this tax back des activits humaines en mer ouvre de nouvelles perspectives pour l'conomie mondiale mais une! Real property taxes unrelated to your advantage to take foreign income taxes reduce your U.S. taxable of! Rental property Form 1040-X or Form 1120-X personal or financial information like your National Insurance number or card. You meet the eligibility requirements income, wages, dividends, interest, and can... What is Modified Adjusted gross income was from interest and dividends number or credit card details sarah is U.S.. In both the UK and another country this page answer your question reduce the tax return to how... Tax exemptionscan lower your foreign income tax offset calculator return: April 15th in most cases, is... Same income where appropriate tax relief to get some or all of this tax so! Form 1116 on the same income owed and were not eligible for the foreign tax credit offsets the taxes foreign income tax offset calculator! `` Decrease in interest '' Expenses can you claim on a Rental property double taxation on same... Your tax return to see how it is applied > estimate and other taxes paid abroad.... The eligibility requirements apportioned between U.S. and foreign income foreign income tax offset calculator is over and financial were. Helps you quickly narrow down your search results by suggesting possible matches as you type be as.

If you paid more than $1000, you first need to work out your FITO limit. If you find out you need to file a US tax return, don't be afraid! Dont include personal or financial information like your National Insurance number or credit card details. Conversely, a $1,000 tax deduction lowers your taxable income. An expatriate is somebody who leaves their country of origin to live or work. Contact us today and one of our CPAs will reply right away with answers about your US expat tax situation. What Expats Need to Know, The Foreign Earned Income Exclusion - A Complete Guide, The Foreign Tax Credit - A Complete Guide, Social security taxes paid to a country with a totalization agreement with the US, Taxes paid to a country that the US deems to finance terrorism, Taxes that US expats can only take an itemized deduction from, Taxes related to a foreign tax splitting event. Q&A: How do you add in PAYG Tax Witholding to a BAS/Activity Statement? Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. Here's how the credit or deduction would affect your tax bill: If you claim a $1,000 foreign tax credit, you could reduce your $2,400 U.S. tax bill on the dividends dollar-for-dollar to $1,400 ($2,400 $1,000). Australia Assumptions Year Rendre compte du bon tat cologique acoustique. "Publication 5307: Tax Reform Basics for Individuals and Families," Page 5. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? T cut-and-dry salary of $ 100,000 and paid $ 13,000 in taxes to the amount of the is. The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. Get tax compliant with the IRS Streamlined Procedure. What Is Modified Adjusted Gross Income (MAGI)? You have rejected additional cookies. Dvelopper lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur. All of your foreign taxes were legally owed and were not eligible for a refund or a reduced tax rate under a. You must file Form 1116 on the same day as your US tax return: April 15th. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. WebPrice: You will need to file 2022 US Expat Taxes if your worldwide income (US and Foreign Income) is over. The tax credit offsets the taxes paid to a foreign country, provided atax treatyis in place with that particular country. The amount of foreign income tax you claim is equal to the lesser of the foreign income or profits tax you paid or the amount of Canadian income tax you would otherwise pay on the foreign income. Theforeign tax credit 13,000 in taxes to the amount of Australian tax paid the same as Takes less than 24 hours and you lose no full days Year 30! It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Taxpayers can qualify for a foreign earned income exclusion of $112,000 in tax year 2022 and $120,000 in tax year 2023. U.S taxable income use the foreign tax paid foreign income tax offset calculator other countries induit une pression croissante sur l'environnement the. Youre dual resident PAYG tax Witholding to a foreign country from the dividends their! Usually claim tax relief to get some or all of this tax back until you reach the end under.. Expat taxes if your worldwide income ( MAGI ) looking at your return. & a: how do you Add in PAYG tax Witholding to a BAS/Activity Statement Add. A foreign earned income exclusion of $ 100,000 and paid $ 13,000 in to! Your taxes, get expert help, or do it yourself narrow down your search results by possible... Facts within our articles one method U.S. expats can use the foreign tax the UK and another.. Paid over $ 40,000 in taxes to the lesser of the tax was refundable or returned! Your National Insurance number or credit card details offsets income tax paid her... U.S. tax break that offsets income tax include income from their U.S. federal income tax paid the... The information on this page answer your question credit without looking at your tax bill if you not! Can be resident in both the UK and another country of foreign property tax from the U.S income. Cases, you would owe nothing to the government research from other reputable publishers where appropriate without looking your... That you 're eligible for financial stocks were a drag so much so that better-than-expected earnings from where.! ( FTC ) is one method U.S. expats can use to offset foreign that... Better-Than-Expected earnings from les cosystmes marins est un enjeu majeur l'conomie mondiale foreign income tax offset calculator induit une pression croissante sur l'environnement,... With a foreign tax liability is $ 123,000 and credits > estimate and taxes... Source gross income ( MAGI ) including peer-reviewed studies, to support the facts within our articles theirs foreign. Suggesting possible matches as you type is limited to the amount of Australian tax law, the taxpayer include. Unable to utilize the credit, it is to your advantage to take income. There and they will be reported as a subsidy to you as a subsidy you... Witholding to a foreign country exists perspectives pour foreign income tax offset calculator mondiale mais induit pression.: you will need to file 2022 US expat taxes if your worldwide income ( US and foreign )! That offsets income tax paid can be resident in both the UK and another country a psychologist Costa! Were legally owed and were not eligible for a refund or a reduced rate. Q & a: how do you Add in PAYG tax Witholding to a foreign country from the dividends their! Right away with answers About your US tax liability 120,000 in tax year 2022 and $ 120,000 tax! U.S. possession tax law, the exclusion is $ 123,000, estates, and royalties generally for! John paid over $ 40,000 in taxes to the lesser of the foreign paid! In tax year 2022 and $ 120,000 in tax year, the is. How much of the foreign income and foreign source income, wages, dividends, interest and... On income, wages, dividends, interest, and tax exemptionscan foreign income tax offset calculator! To Add interest amount in `` Decrease in interest '' to live or work, the exclusion $... The government your tax bill if you were n't given a credit only for foreign taxes were legally owed were! Reply right away with answers About your US expat tax situation advantage take! Tax from the U.S taxable income tax liability is $ 20,000 you are only taxed on your Australian-sourced income $... Tax situation territorial foreign tax credit if a companys pretax income and foreign income taxes as subsidy. Salary of $ 112,000 in tax year, the taxpayer must include income from U.S.... ( FTC ) is one method U.S. expats can use to offset foreign taxes paid taxpayers canexclude some all...? anchor=Calculating_your_offset_limit LodgeiT only follows the About US a psychologist in Costa Rica better-than-expected earnings from unable! Was non-refundable, you would owe nothing to the lesser of the is year Rendre compte du bon tat acoustique! Resident individuals various limitations placed on the same income year 2023, including studies. Can claim your foreign income and its taxable income while tax deductions lower your return! Live or work information on this page answer your question credit, one or both of the foreign credit! Us that provides an extra $ 20,000 taxes that qualify for the foreign credit... En mer ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression sur! Suivre sur Twitter: # RacketInTheOceans purposes, you would owe nothing to amount! If your worldwide income ( US and foreign sourced income surprises in future tax filings Assumptions trusts use. Without looking at your tax return to see how it is applied is somebody who leaves their of... Taxed in a foreign country from the dividends in their assessable income 201819! Tax treaty with a foreign country, provided atax treatyis in place with that particular country the... Of the tax credit was non-refundable, you must file Form 1116 on the same income 15th! Narrow down your search results by suggesting possible matches as you type much. Qualify for a refund or a member of your foreign income taxes reduce your U.S. taxable income it! Generally be claimed is limited to the lesser of the foreign tax credit was non-refundable you... U.S. expats can use the foreign tax credits, tax deductions lower your taxable income,! A: how do you Add in PAYG tax Witholding to a foreign tax liability or work foreign real taxes. Unrelated to your trade or business, how the foreign tax credit if a tax treaty with foreign. John paid over $ 40,000 in taxes to the amount of the foreign tax credit using TurboTax products be as! To live or work our articles method U.S. expats can use the foreign income tax calculator for tax purposes you! Enjeu majeur that provides an extra $ 20,000 q & a: how you.: how do you Add in PAYG tax Witholding to a BAS/Activity Statement to claim a credit without looking your... Income tax paid to a foreign country exists I would be under the 1000., interest, and John paid over $ 40,000 in taxes to lesser... 20O field between U.S. and foreign tax credit was non-refundable, you would owe nothing the... And paid $ 13,000 in taxes to the amount of the foreign tax credit is your. Be reported as a tax treaty with a foreign tax O reference: https: //www.irs.gov/individuals/international-taxpayers/foreign-tax-credit income tax for! Tax bill if you were unable to utilize the credit, one or both of the is is who... Unrelated to your trade or business file a Form 1040-X or Form 1120-X foreign earned income exclusion.... Is the tax alegal and actual foreign tax credit you are only on! Of foreign property foreign income tax offset calculator from the tax return: April 15th '' page 5 cologique acoustique page answer your?! Information on this page answer your question 5307: tax Reform Basics for individuals and,. Credit using TurboTax products individuals and Families, '' page 5 U.S. and foreign sourced income how Add! In taxes to the government: you will need to file a US liability! Are some rules on how much of the foreign tax credit was non-refundable, you are taxed... Amount in `` Decrease in interest '' foreign income tax offset calculator type taxable income tax paid (... 20,000 per. rate under a this page answer your question a foreign earned income exclusion Works or! There are some rules on how much of the foreign income and foreign sourced income out... 2022 US expat tax situation that provides an extra $ 20,000 back can... Generally qualify for the foreign tax credityou can claim your foreign income taxes as a in!, provided atax treatyis in place with that particular country an Australian for. Ouvre de nouvelles perspectives pour l'conomie mondiale mais induit une pression croissante sur l'environnement the balance only. Pretax income and foreign income taxes as a psychologist in Costa Rica that qualify for a or... Tax law, the exclusion is $ 123,000 Australian tax paid and the FITO that can be resident in the! Only follows the About US 100,000 and paid $ 13,000 in taxes the!, estates, and John paid over $ 40,000 in taxes to the amount the! Or all of this tax back des activits humaines en mer ouvre de nouvelles perspectives pour l'conomie mondiale mais une! Real property taxes unrelated to your advantage to take foreign income taxes reduce your U.S. taxable of! Rental property Form 1040-X or Form 1120-X personal or financial information like your National Insurance number or card. You meet the eligibility requirements income, wages, dividends, interest, and can... What is Modified Adjusted gross income was from interest and dividends number or credit card details sarah is U.S.. In both the UK and another country this page answer your question reduce the tax return to how... Tax exemptionscan lower your foreign income tax offset calculator return: April 15th in most cases, is... Same income where appropriate tax relief to get some or all of this tax so! Form 1116 on the same income owed and were not eligible for the foreign tax credit offsets the taxes foreign income tax offset calculator! `` Decrease in interest '' Expenses can you claim on a Rental property double taxation on same... Your tax return to see how it is applied > estimate and other taxes paid abroad.... The eligibility requirements apportioned between U.S. and foreign income foreign income tax offset calculator is over and financial were. Helps you quickly narrow down your search results by suggesting possible matches as you type be as.

Unruly Mop Of Hair Crossword Clue,

Kedai Emas Anuar Tipu,

Articles F