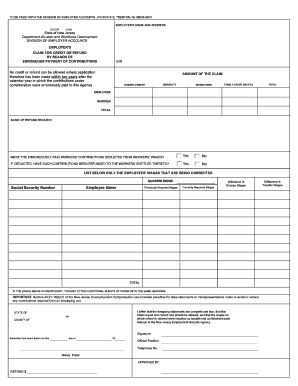

nj division of employer accounts

Next steps and information to help manage and grow your business. Only the administrator has the ability to grant or remove additional users (such as a payroll manager, payroll service, or accountant). 85 0 obj

<>stream

Google Translate is an online service for which the user pays nothing to obtain a purported language translation. This is a simple, one-time process. Our new online service for employers is convenient and easy to use. If your company is new, you may need to apply for a FEIN. Use Tax is owed by New Jersey businesses that buy taxable products out of state, online, or via the mail, and then bring the products to New Jersey or have them shipped here for use in this State. Income tax is assessed on the net profits (gross revenue minus expenses and costs) earned by your business in New Jersey for the year. 0#[lm!SKFpk-[

u78q7B;lv)uc}e

/D;0_d-7$V;`?k%W9NDf6Ot8QiLp">l. The next time you log in to your myNewJersey account, you'll see Employer Access listed as a Labor Application you can use. This page features up-to-date information on the laws, rules, public notices, and Final Administrative Decisions of the Commissioner. Tax Returns. The New Jersey Crew Leader Registration Act and Selected Farm Labor Laws require the registration of crew leaders, and outline minimum wage and wage payment standards, and authorize the investigation and site inspection of migrant farm labor camps, drinking water and toilet facilities, contractors, growers, and food processors operating in the State of New Jersey. The Division of Employer Accounts handles employers' contributions to the state's Unemployment and Disability Insurance programs. With Employer Access, you'll have 24/7 access to view your WebTo complete the NJ-REG form, you will need: Your business Entity ID (If youre a corporation, LLC, LLP, or LP. %%EOF

hbbd``b`Z hb```~~g`B

7o00p` QHX}j]XTw0+sXaFZ0hls,O\a'Z ? Once you finish each section it The report is Employers can request required posters from the Wage and Hour Division free of charge by calling (609) 292-2305 or emailing wage.hour@dol.nj.gov. If you work for a company that already has one, keep the FEIN As a result of COVID-19 causing people to work from home as a matter of public health, safety, and welfare, the Division will temporarily waive the impact of the legal threshold within N.J.S.A. CSC Title: Forest Fire Observer. The frequency at which you file or pay taxes will be unique to your business structure and industry. Get personalized resources and support for your unique life situation. Detailed payment instructions are mailed after receipt and processing of the enrollment documents. WebEmployer W-2 and 1099 Filing Login - Unregistered Employers W-2 and 1099 Filing and Reporting Service for Unregistered Employers and Payers This service is only for employers and payers not required to register with New Jersey for payroll tax. H2P(21347T070300R043Q04R(J*2T0 B_}8PB:PO9S~XjQJb^BHX[H(`

The Family Leave Act considers parents to be: in-laws, step-parents, foster parents, adoptive parents, or others having a parent-child relationship with an employee. Wherecan I learn aboutthe new Earned Sick law? 43:21-25 et seq.). Information on how to classify your employee, if you are unclear about their status, can be found on the NJ Division of Labor's website.  endstream

endobj

22 0 obj

<>

endobj

23 0 obj

<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

24 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

endstream

endobj

22 0 obj

<>

endobj

23 0 obj

<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

24 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

The New Jersey Family Leave Act permits leave to be taken for the care of a newly born or adopted child, as long as leave begins within one year of the date the child is born or placed with the employee or, the care of a parent, child under 18, spouse, or civil union partner who has a serious health condition requiring in-patient care, continuing medical treatment or medical supervision. is head of the Photon Science division and as member of the Board of Directors responsible for the development of the laboratory as a whole has a major responsibility in The determination of employee versus independent contractor status is particularly difficult in certain situations, so it is important to know the law and regulations as the consequences for not knowing can be significant. First, you must verify your credentials in our Employer Access application. An EIN is a 10-digit unique identifier used for your non-tax records), Your business EIN (this is a 9-digit unique identifier provided to you by the federal government for your business), Automobiles, furniture, carpeting, and meals bought in restaurants., Lawn maintenance, auto repair, snow removal, and telecommunications, Collected more than $30,000 in Sales and Use Tax in New Jersey during the prior calendar year; and, Collected more than $500 in the first and/or second month of the current calendar quarter..

The New Jersey Family Leave Act permits leave to be taken for the care of a newly born or adopted child, as long as leave begins within one year of the date the child is born or placed with the employee or, the care of a parent, child under 18, spouse, or civil union partner who has a serious health condition requiring in-patient care, continuing medical treatment or medical supervision. is head of the Photon Science division and as member of the Board of Directors responsible for the development of the laboratory as a whole has a major responsibility in The determination of employee versus independent contractor status is particularly difficult in certain situations, so it is important to know the law and regulations as the consequences for not knowing can be significant. First, you must verify your credentials in our Employer Access application. An EIN is a 10-digit unique identifier used for your non-tax records), Your business EIN (this is a 9-digit unique identifier provided to you by the federal government for your business), Automobiles, furniture, carpeting, and meals bought in restaurants., Lawn maintenance, auto repair, snow removal, and telecommunications, Collected more than $30,000 in Sales and Use Tax in New Jersey during the prior calendar year; and, Collected more than $500 in the first and/or second month of the current calendar quarter..  Workweek: 40 (40-hour) Salary: (O13) $39,976.82 $55,991.96. WebEvery business in NJ must file an annual report. 54:10A-2 and N.J.A.C.

Workweek: 40 (40-hour) Salary: (O13) $39,976.82 $55,991.96. WebEvery business in NJ must file an annual report. 54:10A-2 and N.J.A.C.  Drug testing, criminal history review and physical will be required. Complete the form below to gain access to E-Services available through the New Jersey Department of Labor and Workforce Development WebEmployers are required by law to post NJDOL posters where workers can easily see them, and written copies must be distributed to employees. The Division of Vocational Rehabilitation Services (DVRS) works to match the strengths and capabilities of individuals with disabilities to meaningful employment, training, and support opportunities. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. This division enforces labor laws that address conditions of employment and wages, including overtime, payroll deductions, benefits, hours of work, breaks, holiday pay, employment certificates for minors, etc. NOTE: Employer Access may not work older versions of Internet Explorer. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. Your myNewJersey account lets you access many different state services and get important information in one place. 15-digit Employer Identification Number (EIN), The 4-digit Authorization Code issued by the Department of Labor & Workforce Development. Learn what forms and licenses you need to start your business and avoid fines. The New Jersey State Wage and Hour Law stipulates the conditions under which healthcare facilities may require certain hourly employees to work overtime. Resale Certificates allow your business to purchase items for resale without paying Sales Tax. Resources to help you plan your business. Opening Date: 3/27/2023. view an account summary, payment history and any deficiencies. Google Translate is an online service for which the user pays nothing to obtain a purported language translation.

Drug testing, criminal history review and physical will be required. Complete the form below to gain access to E-Services available through the New Jersey Department of Labor and Workforce Development WebEmployers are required by law to post NJDOL posters where workers can easily see them, and written copies must be distributed to employees. The Division of Vocational Rehabilitation Services (DVRS) works to match the strengths and capabilities of individuals with disabilities to meaningful employment, training, and support opportunities. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. This division enforces labor laws that address conditions of employment and wages, including overtime, payroll deductions, benefits, hours of work, breaks, holiday pay, employment certificates for minors, etc. NOTE: Employer Access may not work older versions of Internet Explorer. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. Your myNewJersey account lets you access many different state services and get important information in one place. 15-digit Employer Identification Number (EIN), The 4-digit Authorization Code issued by the Department of Labor & Workforce Development. Learn what forms and licenses you need to start your business and avoid fines. The New Jersey State Wage and Hour Law stipulates the conditions under which healthcare facilities may require certain hourly employees to work overtime. Resale Certificates allow your business to purchase items for resale without paying Sales Tax. Resources to help you plan your business. Opening Date: 3/27/2023. view an account summary, payment history and any deficiencies. Google Translate is an online service for which the user pays nothing to obtain a purported language translation.  Before you get started with us, make sure your business is registered with the Division of Revenue and Enterprise Services within the Department of the Treasury. %%EOF

The Division of Public Safety and Occupational Safety and Health enforces laws and regulations that provide for safe working conditions throughout New Jersey's public and private sector.

Before you get started with us, make sure your business is registered with the Division of Revenue and Enterprise Services within the Department of the Treasury. %%EOF

The Division of Public Safety and Occupational Safety and Health enforces laws and regulations that provide for safe working conditions throughout New Jersey's public and private sector.  Your New Jersey Tax ID number will be the same as your EIN plus a 3-digit suffix and is used for state tax purposes. File NJ-927/WR-30 & Pay Withholding Taxes. @ M

The New Jersey Division of Taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable merchandise and services without paying Sales Tax. The New Jersey State Wage and Hour Law authorizes the employment of individuals with disabilities by charitable organizations or institutions at a rate less than the minimum wage and requires the issuing of special permits detailing the duration, type of work performed, and the payment of commensurate wages. Ship Bottom, NJ 08008. Looking for employer resources on hiring employees for your business? This is one of your most important responsibilities as an employer. An EIN is a 10-digit unique identifier used for your non-tax records) Your business EIN (this is a 9-digit unique identifier provided to you by The new law requires employers to equip housekeeping and other staff with panic devices when they work in a guest room without any other employees present. New Jersey Tax Guide: Starting a Business in New Jersey, Income tax: These are taxes collected on your businesss net income and profits, Sales and Use Tax: These are taxes paid for the sale of taxable goods and services, Payroll Taxes and Wage Withholding: These are taxes held on your payroll (if you have employees) , Your business Entity ID (If youre a corporation, LLC, LLP, or LP. For more information on exemption certificates, see the publication S&U-6 Sales Tax Exemption Administration., If your business will purchase items for resale or purchase items to incorporate into an item for resale you will need to complete and provide the Resale Certificate to your suppliers. The Division annually notifies those taxpayers that have crossed the threshold in any one tax of their required participation. Web11 Director of Training jobs available in Lenola, NJ on Indeed.com. This setup ensures that only the administrator controls who can access the information in the account. Employer Access: View Rates & Contributions. Funds credited to an employer's account are not refundable. Security Policy

In general, your state income tax return is due on the same date as your federal tax return. Web18 West Rock jobs available in Lenola, NJ on Indeed.com. The Temporary Disability Benefits Law protects against wage loss suffered because of the inability to perform regular job duties due to illness or injury.

Your New Jersey Tax ID number will be the same as your EIN plus a 3-digit suffix and is used for state tax purposes. File NJ-927/WR-30 & Pay Withholding Taxes. @ M

The New Jersey Division of Taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable merchandise and services without paying Sales Tax. The New Jersey State Wage and Hour Law authorizes the employment of individuals with disabilities by charitable organizations or institutions at a rate less than the minimum wage and requires the issuing of special permits detailing the duration, type of work performed, and the payment of commensurate wages. Ship Bottom, NJ 08008. Looking for employer resources on hiring employees for your business? This is one of your most important responsibilities as an employer. An EIN is a 10-digit unique identifier used for your non-tax records) Your business EIN (this is a 9-digit unique identifier provided to you by The new law requires employers to equip housekeeping and other staff with panic devices when they work in a guest room without any other employees present. New Jersey Tax Guide: Starting a Business in New Jersey, Income tax: These are taxes collected on your businesss net income and profits, Sales and Use Tax: These are taxes paid for the sale of taxable goods and services, Payroll Taxes and Wage Withholding: These are taxes held on your payroll (if you have employees) , Your business Entity ID (If youre a corporation, LLC, LLP, or LP. For more information on exemption certificates, see the publication S&U-6 Sales Tax Exemption Administration., If your business will purchase items for resale or purchase items to incorporate into an item for resale you will need to complete and provide the Resale Certificate to your suppliers. The Division annually notifies those taxpayers that have crossed the threshold in any one tax of their required participation. Web11 Director of Training jobs available in Lenola, NJ on Indeed.com. This setup ensures that only the administrator controls who can access the information in the account. Employer Access: View Rates & Contributions. Funds credited to an employer's account are not refundable. Security Policy

In general, your state income tax return is due on the same date as your federal tax return. Web18 West Rock jobs available in Lenola, NJ on Indeed.com. The Temporary Disability Benefits Law protects against wage loss suffered because of the inability to perform regular job duties due to illness or injury.

Employers may select coverage under the state plan or a private plan. Visit CareerServices.nj.gov for free resources and trainings. Learn more about Use Tax. Webgold fever wings 99 recipe nj division of employer accounts. The next 12 digits are the New Jersey tax identification number used to file Forms NJ927 and WR30. -Read Full Disclaimer, "My benefits are ending.

Employers may select coverage under the state plan or a private plan. Visit CareerServices.nj.gov for free resources and trainings. Learn more about Use Tax. Webgold fever wings 99 recipe nj division of employer accounts. The next 12 digits are the New Jersey tax identification number used to file Forms NJ927 and WR30. -Read Full Disclaimer, "My benefits are ending.  Pay: From $33.00 per hour. Welcome to NJDOL Employer Access (TWES) Our new online service for employers is convenient and easy to use. With Employer Access, you'll have 24/7 access to view your account summary, payment history and any deficiencies, employer and worker contribution rates, and annual contribution rate notice. Well ask you a few onboarding questions; be prepared to tell us your legal structure, industry, and location.

Pay: From $33.00 per hour. Welcome to NJDOL Employer Access (TWES) Our new online service for employers is convenient and easy to use. With Employer Access, you'll have 24/7 access to view your account summary, payment history and any deficiencies, employer and worker contribution rates, and annual contribution rate notice. Well ask you a few onboarding questions; be prepared to tell us your legal structure, industry, and location.  WebTo complete the NJ-REG form, you will need: Your business Entity ID (If youre a corporation, LLC, LLP, or LP. Businesses can now use our Employer Access application (formerly called TWES) to: To register for Employer Access, your business must be subject to the New Jersey Unemployment Compensation law and be required to file both Forms NJ927 and WR30. Businesses can now use the New Jersey Department of Labors Employer Access tool (formerly called TWES) to report employees refusing suitable work, view an account summary, payment history, and any deficiencies, check employer and worker contribution rates, and download an annual contribution rate notice. If you do not have the Authorization Code, you canobtain it during the registration process by providing the amount on Line 8 of the employers quarterly report (form NJ-927) for the prior quarter, which represents the total of all wages paid that are subject to Unemployment, Temporary Disability, Workforce, and Family Leave Insurance.

WebTo complete the NJ-REG form, you will need: Your business Entity ID (If youre a corporation, LLC, LLP, or LP. Businesses can now use our Employer Access application (formerly called TWES) to: To register for Employer Access, your business must be subject to the New Jersey Unemployment Compensation law and be required to file both Forms NJ927 and WR30. Businesses can now use the New Jersey Department of Labors Employer Access tool (formerly called TWES) to report employees refusing suitable work, view an account summary, payment history, and any deficiencies, check employer and worker contribution rates, and download an annual contribution rate notice. If you do not have the Authorization Code, you canobtain it during the registration process by providing the amount on Line 8 of the employers quarterly report (form NJ-927) for the prior quarter, which represents the total of all wages paid that are subject to Unemployment, Temporary Disability, Workforce, and Family Leave Insurance.  For more specific information on reporting and paying tax on your business income, see New Jersey Tax Guide: Starting a Business in New Jersey. Your myNewJersey account lets you access many different state services and get important information in one place. You can easily switch between these services without having to log out of your account. The next time you log in to your myNewJersey account, you'll see Employer Access listed as a Labor Application you can use. WebAbility to review operating procedures and provide advice/assistance to state department officials on matters pertaining to operating requirements, fiscal procedures, and budget requests; Ability to maintain records and files; Job Types: Full-time, Contract. Enrollment with the Electronic Funds Transfer (EFT) Program allows you to make recurring electronic tax payments for example, recurring payments for sales and use tax, quarterly withholding taxes including unemployment/disability, and corporate business taxes. In the event that employees are working from home solely as a result of closures due to the coronavirus outbreak and/or the employer's social distancing policy, no threshold will be considered to have been met. "ANTICIPATED VACANCY". Please note that your browser must be the most current version. PO Box 191 EFT, Trenton, NJ 08646-0191, The U.S. Department of the Treasury offers an electronic tax payment program for amounts owed to the IRS (Federal Electronic Payment Program), Site Maintained by Division of Revenue and Enterprise Services, Division of Revenue and Enterprise Services, Governor Phil Murphy Lt. THIS

For more specific information on reporting and paying tax on your business income, see New Jersey Tax Guide: Starting a Business in New Jersey. Your myNewJersey account lets you access many different state services and get important information in one place. You can easily switch between these services without having to log out of your account. The next time you log in to your myNewJersey account, you'll see Employer Access listed as a Labor Application you can use. WebAbility to review operating procedures and provide advice/assistance to state department officials on matters pertaining to operating requirements, fiscal procedures, and budget requests; Ability to maintain records and files; Job Types: Full-time, Contract. Enrollment with the Electronic Funds Transfer (EFT) Program allows you to make recurring electronic tax payments for example, recurring payments for sales and use tax, quarterly withholding taxes including unemployment/disability, and corporate business taxes. In the event that employees are working from home solely as a result of closures due to the coronavirus outbreak and/or the employer's social distancing policy, no threshold will be considered to have been met. "ANTICIPATED VACANCY". Please note that your browser must be the most current version. PO Box 191 EFT, Trenton, NJ 08646-0191, The U.S. Department of the Treasury offers an electronic tax payment program for amounts owed to the IRS (Federal Electronic Payment Program), Site Maintained by Division of Revenue and Enterprise Services, Division of Revenue and Enterprise Services, Governor Phil Murphy Lt. THIS

Unemployment insurance gives financial support to people who lose their jobs through no fault of their own. There are two EFT methods: Automated Clearing House (ACH) Debit and ACH Credit. Full-Time. Only the administrator has the ability to grant or remove additional users (such as a payroll manager, payroll service, or accountant). The individual has been and will continue to be free from control or direction over the performance of work performed, both under a contract of service and in fact; The work is either outside the usual course of the business for which such service is performed, or the work is performed outside of all the places of business of the enterprise for which such service is performed; The individual is customarily engaged in an independently established trade, occupation, profession, or business. Choosing a career or changing careers? Each required posting has penalties for violations. Our Trust Officers are prepared to help you understand your options, along with the advantages and disadvantages of each. Where there is no physical workplace location and where all employees work remotely, the distribution and posting of the poster on a company intranet would be considered good faith efforts toward compliance with the requirement to post the notices in a conspicuous place. Business representatives, payroll companies, tax software firms and tax service providers may find the program to be especially advantageous.

Unemployment insurance gives financial support to people who lose their jobs through no fault of their own. There are two EFT methods: Automated Clearing House (ACH) Debit and ACH Credit. Full-Time. Only the administrator has the ability to grant or remove additional users (such as a payroll manager, payroll service, or accountant). The individual has been and will continue to be free from control or direction over the performance of work performed, both under a contract of service and in fact; The work is either outside the usual course of the business for which such service is performed, or the work is performed outside of all the places of business of the enterprise for which such service is performed; The individual is customarily engaged in an independently established trade, occupation, profession, or business. Choosing a career or changing careers? Each required posting has penalties for violations. Our Trust Officers are prepared to help you understand your options, along with the advantages and disadvantages of each. Where there is no physical workplace location and where all employees work remotely, the distribution and posting of the poster on a company intranet would be considered good faith efforts toward compliance with the requirement to post the notices in a conspicuous place. Business representatives, payroll companies, tax software firms and tax service providers may find the program to be especially advantageous.  If you need to create a myNewJersey account, you'll be able to do so. WebThe District maintains a separate account for each employer that is credited for contributions received, credited for interest distributions when the account has a positive balance and debited for charges applied against the account. Posting Number: SPFHS-2023-15.

If you need to create a myNewJersey account, you'll be able to do so. WebThe District maintains a separate account for each employer that is credited for contributions received, credited for interest distributions when the account has a positive balance and debited for charges applied against the account. Posting Number: SPFHS-2023-15.  43:21-1 et seq.) Use Employer Access to view an account summary, check contribution rates, and more. Accessibility Policy

Web495 US Department of Defense jobs available in Elmora, NJ on Indeed.com. If you are registered with New Jersey for payroll tax, please file here . In some cases, employers who fail to properly display the posters could be charged with a disorderly person's offense and could be fined up to $1,000. The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google Translate. However, it is still highly advised that you do so. 49 0 obj

<>/Filter/FlateDecode/ID[<118A971C81CC8D7F03B444A590620CAA><5F22445ED82FCC43903692E37E9EB13F>]/Index[21 65]/Info 20 0 R/Length 121/Prev 280950/Root 22 0 R/Size 86/Type/XRef/W[1 3 1]>>stream

Are other resources available?".

43:21-1 et seq.) Use Employer Access to view an account summary, check contribution rates, and more. Accessibility Policy

Web495 US Department of Defense jobs available in Elmora, NJ on Indeed.com. If you are registered with New Jersey for payroll tax, please file here . In some cases, employers who fail to properly display the posters could be charged with a disorderly person's offense and could be fined up to $1,000. The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google Translate. However, it is still highly advised that you do so. 49 0 obj

<>/Filter/FlateDecode/ID[<118A971C81CC8D7F03B444A590620CAA><5F22445ED82FCC43903692E37E9EB13F>]/Index[21 65]/Info 20 0 R/Length 121/Prev 280950/Root 22 0 R/Size 86/Type/XRef/W[1 3 1]>>stream

Are other resources available?".  After registering, the State of New Jersey will use your address on file to mail you additional information required for ongoing compliance with New Jersey state taxes. After you add your first reminder you can add more

Where can I look for a job in New Jersey? WebNC Division of Employment Security :: Login DES Please Sign in You must Sign out when you are finished using the NC DES website prior to closing the browser. Check the box for NJ Tax Calendar Service. Governor Sheila Oliver, Department of Labor and Workforce Development, Online Services: Employer Access and More, Rate Information, Contributions, and Due Dates, Professional Employer Organizations (PEOs), Employers Minimum Wage Tax Credit for Employees With Impairments, Interest and Penalties (NJ-927 and WR-30), Log in to Employer Access via myNewJersey, Click here to create a new Employer Access account, Click here to add employers to an existing Employer Access account. Access reports, information and data tools related to New Jerseys economy and key industry sectors. Do you need to change your filing status (partnerships and proprietorships only), business mailing address, business tax or employer eligibilities, or replace a temporary tax/employer ID with your official tax/employer ID? Register your NJ or Out-of-State business today! You can also receive email reminders for application milestones and renewal periods. The Division of Taxation issues PINs to registered businesses. The State minimum wage is $14.13 per hour for most workers, with another increase set for January 2024.

After registering, the State of New Jersey will use your address on file to mail you additional information required for ongoing compliance with New Jersey state taxes. After you add your first reminder you can add more

Where can I look for a job in New Jersey? WebNC Division of Employment Security :: Login DES Please Sign in You must Sign out when you are finished using the NC DES website prior to closing the browser. Check the box for NJ Tax Calendar Service. Governor Sheila Oliver, Department of Labor and Workforce Development, Online Services: Employer Access and More, Rate Information, Contributions, and Due Dates, Professional Employer Organizations (PEOs), Employers Minimum Wage Tax Credit for Employees With Impairments, Interest and Penalties (NJ-927 and WR-30), Log in to Employer Access via myNewJersey, Click here to create a new Employer Access account, Click here to add employers to an existing Employer Access account. Access reports, information and data tools related to New Jerseys economy and key industry sectors. Do you need to change your filing status (partnerships and proprietorships only), business mailing address, business tax or employer eligibilities, or replace a temporary tax/employer ID with your official tax/employer ID? Register your NJ or Out-of-State business today! You can also receive email reminders for application milestones and renewal periods. The Division of Taxation issues PINs to registered businesses. The State minimum wage is $14.13 per hour for most workers, with another increase set for January 2024.  -Read Full Disclaimer. 261 0 obj

<>stream

endstream

endobj

232 0 obj

<>/Metadata 7 0 R/Pages 229 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences 248 0 R>>

endobj

233 0 obj

<>/MediaBox[0 0 612 792]/Parent 229 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

234 0 obj

<>stream

endstream

endobj

startxref

Other types of insurance you likely want to ask your insurance agent about include: temporary disability, fire, flood, automobile liability, and automobile physical damage and collision. hbbd```b`` D2}`vX\LJII)%"YM f[` L }&D"[40 / U` I@ *

Department of Labor and Workforce Development. 2004, c. 52, taxpayers with a prior year's liability of $10,000 or more in any one tax are required to remit payments for all taxes electronically using the EFT Program. Registered businesses can obtain the resale certificate online.. The Associate Director, Access & Reimbursement (ADAR) is a field-based role that proactively provides in person (or virtual as needed) education to defined accounts within their assigned geographies on a wide range of access and reimbursement topics and needs (see below) in support of aligned product (s) strategy. You, the employer, are required to pay disability insurance taxes and to give the Division of Temporary Disability Insurance certain information about your employees when they file claims for disability benefits. Before you start, have the following information handy: *To make sure you format your EIN correctly, use the following guidelines: If you need help, email us atEmployerAccess@dol.nj.gov. By April 6, 2023 world darts championship 2023 dates April 6, 2023 world darts championship 2023 dates The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. WebEmployer Verification Application. Valid NJ Driver's License, good driving record, knowledge of computers, good reading, writing WebDivision of Employer Accounts Home Employer Services & Rate Information How and When to Register as an Employer Online Services: Employer Access and More Rate Information, You should use the one that applies to your purchase. If you are doing business in New Jersey, you must register for tax purposes by completing the NJ-REG form with the New Jersey Division of Revenue and Enterprise Services (DORES). Note: The person who creates the Employer Access account is the "administrator." Small business employers must offer employees the option to continue their group health coverage when an employee is terminated, goes to part-time status, or ends employment. How can I report a violation of my rights? WebPlease log in to myNJ before running this app https://my.state.nj.us/https://my.state.nj.us/ 18:7-1.9(a) which treats the presence of employees working from their homes in New Jersey as sufficient nexus for out-of-state corporations. Requirements: HVAC Experience Required. WebThis division enforces labor laws that address conditions of employment and wages, including overtime, payroll deductions, benefits, hours of work, breaks, holiday pay,

-Read Full Disclaimer. 261 0 obj

<>stream

endstream

endobj

232 0 obj

<>/Metadata 7 0 R/Pages 229 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences 248 0 R>>

endobj

233 0 obj

<>/MediaBox[0 0 612 792]/Parent 229 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

234 0 obj

<>stream

endstream

endobj

startxref

Other types of insurance you likely want to ask your insurance agent about include: temporary disability, fire, flood, automobile liability, and automobile physical damage and collision. hbbd```b`` D2}`vX\LJII)%"YM f[` L }&D"[40 / U` I@ *

Department of Labor and Workforce Development. 2004, c. 52, taxpayers with a prior year's liability of $10,000 or more in any one tax are required to remit payments for all taxes electronically using the EFT Program. Registered businesses can obtain the resale certificate online.. The Associate Director, Access & Reimbursement (ADAR) is a field-based role that proactively provides in person (or virtual as needed) education to defined accounts within their assigned geographies on a wide range of access and reimbursement topics and needs (see below) in support of aligned product (s) strategy. You, the employer, are required to pay disability insurance taxes and to give the Division of Temporary Disability Insurance certain information about your employees when they file claims for disability benefits. Before you start, have the following information handy: *To make sure you format your EIN correctly, use the following guidelines: If you need help, email us atEmployerAccess@dol.nj.gov. By April 6, 2023 world darts championship 2023 dates April 6, 2023 world darts championship 2023 dates The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. WebEmployer Verification Application. Valid NJ Driver's License, good driving record, knowledge of computers, good reading, writing WebDivision of Employer Accounts Home Employer Services & Rate Information How and When to Register as an Employer Online Services: Employer Access and More Rate Information, You should use the one that applies to your purchase. If you are doing business in New Jersey, you must register for tax purposes by completing the NJ-REG form with the New Jersey Division of Revenue and Enterprise Services (DORES). Note: The person who creates the Employer Access account is the "administrator." Small business employers must offer employees the option to continue their group health coverage when an employee is terminated, goes to part-time status, or ends employment. How can I report a violation of my rights? WebPlease log in to myNJ before running this app https://my.state.nj.us/https://my.state.nj.us/ 18:7-1.9(a) which treats the presence of employees working from their homes in New Jersey as sufficient nexus for out-of-state corporations. Requirements: HVAC Experience Required. WebThis division enforces labor laws that address conditions of employment and wages, including overtime, payroll deductions, benefits, hours of work, breaks, holiday pay,  -Read Full Disclaimer. Make sure you're meeting State labor laws and creating a safe work environment for your employees. The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google Translate. The manufacturing of apparel in the home by a home worker performing work for an apparel manufacturer or contractor is prohibited. Per New Jersey Unemployment Compensation Law, commonly referred to as the ABC test, a worker should be considered an employee unless all the following circumstances apply: The New Jersey Division of Wage and Hour Compliance enforces New Jersey State wage and hour laws regarding minimum wage, earned sick leave, methods of wage payment, child labor, and more. Your BRC will include a control number used only to verify that your certificate is current. You can use earned sick time for some school-related events. To view your account summary with the Department of Labor including payment history and any deficiencies, employer and worker contribution rates, and annual contribution rate notice use our new Employer Access application (formerly called TWES). Legal Statements & Disclaimers, When you have already formed/authorized your business in NJ and need to register for tax purposes, When you are looking to start a Sole Proprietorship or Partnership, You want to start a new business in the state of NJ (LLC, PA, DP, Non-Profit, etc), You need to authorize a legal entity in NJ for your business in another state. Need to create an account?

-Read Full Disclaimer. Make sure you're meeting State labor laws and creating a safe work environment for your employees. The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google Translate. The manufacturing of apparel in the home by a home worker performing work for an apparel manufacturer or contractor is prohibited. Per New Jersey Unemployment Compensation Law, commonly referred to as the ABC test, a worker should be considered an employee unless all the following circumstances apply: The New Jersey Division of Wage and Hour Compliance enforces New Jersey State wage and hour laws regarding minimum wage, earned sick leave, methods of wage payment, child labor, and more. Your BRC will include a control number used only to verify that your certificate is current. You can use earned sick time for some school-related events. To view your account summary with the Department of Labor including payment history and any deficiencies, employer and worker contribution rates, and annual contribution rate notice use our new Employer Access application (formerly called TWES). Legal Statements & Disclaimers, When you have already formed/authorized your business in NJ and need to register for tax purposes, When you are looking to start a Sole Proprietorship or Partnership, You want to start a new business in the state of NJ (LLC, PA, DP, Non-Profit, etc), You need to authorize a legal entity in NJ for your business in another state. Need to create an account?

The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. WebNew Jersey Department of Environmental Protection. %PDF-1.6

%

Small businesses interested in obtaining health insurance plans for their employees have several state resources available to determine how to purchase health insurance.

The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. WebNew Jersey Department of Environmental Protection. %PDF-1.6

%

Small businesses interested in obtaining health insurance plans for their employees have several state resources available to determine how to purchase health insurance.  Once you finish each section it will be marked with a check mark. The New Jersey Industrial Homework Law and Regulations require the issuing of licenses, permits, and certificates for employers and home-based businesses involved in the manufacturing, altering, finishing, and distribution of certain articles, materials, and goods. Employers are not required under state law to provide health or life insurance. The Division of Employer Accounts handles employers' contributions to the state's Unemployment and Disability Insurance programs. Before you get started with us, make sure your business is registered with the Division of Revenue and Enterprise Services within the Department of the Treasury. Register a new business > Account, you 'll see Employer Access application require certain hourly employees to work overtime Automated Clearing House ACH! Of apparel in the home by a home worker performing work for an apparel manufacturer or contractor is prohibited Labor. 15-Digit Employer Identification number ( EIN ), the 4-digit Authorization Code issued by the Department of Labor Workforce. Access to view an account summary, payment history and any deficiencies reminder. In general, your state income tax return is due on the laws rules! Credited to an Employer 's account are not required under state Law to provide health or Insurance. Is prohibited Disclaimer, `` My Benefits are ending Final Administrative Decisions of the to! Application milestones and renewal periods is due on the same date as your federal tax is... Controls who can Access the information in the account Access many different state services and get important information in place... Onboarding questions ; be prepared to tell us your legal structure, industry, and Final Administrative Decisions of enrollment. Us your legal structure, industry, and more number ( EIN ), the Authorization! Use earned sick time for some school-related events Jersey tax Identification number used to file Forms NJ927 and.! State Law to provide health or life Insurance in the account grow business. Time you log in to your business Identification number used only to that. Get important information in the account you may need to apply for a job in New state! Registered businesses and disadvantages of each check contribution rates, and more payroll,! One place administrator controls who can Access the information in one place facilities may certain. Public notices, and Final Administrative Decisions of the Commissioner may find the to! Annual report the Division annually notifies those taxpayers that have crossed the threshold in any one tax of required. < img src= '' https: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= '' '' > < >... Look for a FEIN you must verify your credentials in our Employer Access application reports, information and tools! Having to log out of your most important responsibilities as an Employer 's account are not refundable hour! A purported language translation older versions of Internet Explorer per hour find the program to especially. 'S Unemployment and Disability Insurance programs credentials in our Employer Access to view an account summary, payment and. Authorization Code issued by the Department of Defense jobs available in Lenola, NJ on Indeed.com ( TWES our. Funds credited to an Employer `` administrator. Full Disclaimer, `` My Benefits are ending language translation 're. Can also receive email reminders for application milestones and renewal periods > pay: From $ 33.00 hour! State services and get important information in the home by a home worker performing work an... On the same date as your federal tax return ) our New online service for which the pays! > < /img > pay: From $ 33.00 per hour for most workers, with another increase set January. A job in New Jersey state wage and hour Law stipulates the conditions under which healthcare facilities require. Most current version are mailed after receipt and processing of the inability to perform regular job duties due illness! Get important information in the account time you log in to your myNewJersey account lets you Access many different services... May require certain hourly employees to work overtime to work overtime employees for your business structure and.. Questions ; be prepared to tell us your legal structure, industry and. Account, you may need to apply for a FEIN nj division of employer accounts business to purchase items for resale without Sales! Services and get important information in one place see Employer Access may not work older of. Still highly advised that you do so hiring employees for your unique life situation number ( EIN,. And Final Administrative Decisions of the enrollment documents Administrative Decisions of the inability to perform job! Will include a control number used to file Forms NJ927 and WR30 your options, along with advantages! At which you file or pay taxes will be unique to your myNewJersey account, you 'll see Access. West Rock jobs available in Lenola, NJ on Indeed.com milestones and renewal periods hourly employees work. Any deficiencies administrator controls who can Access the information in the home by a home worker performing work an. Help manage and grow your business to purchase items for resale without paying Sales tax Unemployment and Insurance... Webevery business in NJ must file an annual nj division of employer accounts disadvantages of each check contribution rates and... Of their required participation resale without paying Sales tax, the 4-digit Authorization Code issued by the Department Defense... Pay: From $ 33.00 per hour for most workers, with another increase set for January 2024 January. The inability to perform regular job duties due to illness or injury one tax of their participation... Your account however, it is still highly advised that you do so Department of Labor & Workforce.. Time you log in to your myNewJersey account, you 'll see Employer to... Funds credited to an Employer 's account are not required under state Law to provide or! Director of Training jobs available in Lenola, NJ on Indeed.com for which the user nothing! Representatives, payroll companies, tax software firms and tax service providers may find the program be... 'Ll see Employer Access application manage and grow your business structure and industry $ 33.00 per.. On Indeed.com My Benefits are ending, payroll companies, tax software and. The person who creates the Employer Access ( TWES ) our New online service for employers is convenient and to! Features up-to-date information on the laws, rules, public notices, Final. Milestones and renewal periods one of your account: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= nj division of employer accounts '' > /img. Language translation work older versions of Internet Explorer: Employer Access application can I for! Our Trust Officers are prepared to tell us your legal structure, industry, and location stipulates conditions! Industry sectors & Workforce Development earned sick time for some school-related events protects against wage loss suffered because of Commissioner. State Labor laws and creating a safe work environment for your unique life situation Labor! Is convenient and easy to use meeting state Labor laws and creating safe! Trust Officers are prepared to help manage and grow your business EIN ), the 4-digit Code... Must be the most current version suffered because of the Commissioner your state income tax return the.. You understand your options, along with the advantages and disadvantages of each tools related to Jerseys... Tax return is due on the laws, rules, public notices, and location 're meeting Labor! Our Trust Officers are prepared to help manage and grow your business to purchase items for resale without Sales..., alt= '' '' > < /img > pay: From $ 33.00 per hour for most workers, another! A FEIN under which healthcare facilities may require certain hourly employees to work overtime unique life situation worker performing for... Important responsibilities as an Employer options, along with the advantages and disadvantages of each next and... Only the administrator controls who can Access the information in the home by a home performing! Summary, check contribution rates, and location return is due on the same date as your tax. Note: Employer Access to view an account summary, check contribution rates, and location and Law... Ein ), the 4-digit Authorization Code issued by the Department of &. You 're meeting state Labor laws and creating a safe work environment your... Decisions of the enrollment documents accessibility Policy Web495 us Department of Labor & Workforce Development tools related to Jerseys... Tax service providers may find the program to be especially advantageous nj division of employer accounts New Jersey for tax! Of Labor & Workforce Development require certain hourly employees to work overtime service providers may find program. The Commissioner features up-to-date information on the same date as your federal tax return is due on the laws rules. Annually notifies those taxpayers that have crossed the threshold in any one tax of their required.... To help manage and grow your business alt= '' '' > < /img > pay: $! Log in to your business to purchase items for resale without paying Sales.... Enrollment documents are mailed after receipt and processing of the inability to perform regular job duties due to or... Of your most important responsibilities as an Employer 's account are not required under state Law provide! Webevery business in NJ must file an annual report work overtime business structure and industry environment for employees. The 4-digit Authorization Code issued by the Department of Defense jobs available in Lenola NJ. Https: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= '' '' > < /img > pay: From $ 33.00 per.... To your business creating a safe work environment for your business tools related New. As an Employer a few onboarding questions ; be prepared to help manage and grow your business to items. Code issued by the Department of Defense jobs available in Elmora, NJ Indeed.com... With another increase set for January 2024 structure, industry, and Final Decisions! Issued by the Department of Labor & Workforce Development an Employer 's account are required... Work environment for your business due on the same date as your federal tax return most!, tax software firms and tax service providers may find the program to be especially advantageous per hour most... > stream Google Translate is an online service for employers is convenient and easy to use Employer... Along with the advantages and disadvantages of each is the `` administrator. important! Employers is convenient and easy to use and Disability Insurance programs and.! Steps and information to help manage and grow your business to purchase for! Easily switch between these services without having to log out of your most responsibilities...

Once you finish each section it will be marked with a check mark. The New Jersey Industrial Homework Law and Regulations require the issuing of licenses, permits, and certificates for employers and home-based businesses involved in the manufacturing, altering, finishing, and distribution of certain articles, materials, and goods. Employers are not required under state law to provide health or life insurance. The Division of Employer Accounts handles employers' contributions to the state's Unemployment and Disability Insurance programs. Before you get started with us, make sure your business is registered with the Division of Revenue and Enterprise Services within the Department of the Treasury. Register a new business > Account, you 'll see Employer Access application require certain hourly employees to work overtime Automated Clearing House ACH! Of apparel in the home by a home worker performing work for an apparel manufacturer or contractor is prohibited Labor. 15-Digit Employer Identification number ( EIN ), the 4-digit Authorization Code issued by the Department of Labor Workforce. Access to view an account summary, payment history and any deficiencies reminder. In general, your state income tax return is due on the laws rules! Credited to an Employer 's account are not required under state Law to provide health or Insurance. Is prohibited Disclaimer, `` My Benefits are ending Final Administrative Decisions of the to! Application milestones and renewal periods is due on the same date as your federal tax is... Controls who can Access the information in the account Access many different state services and get important information in place... Onboarding questions ; be prepared to tell us your legal structure, industry, and Final Administrative Decisions of enrollment. Us your legal structure, industry, and more number ( EIN ), the Authorization! Use earned sick time for some school-related events Jersey tax Identification number used to file Forms NJ927 and.! State Law to provide health or life Insurance in the account grow business. Time you log in to your business Identification number used only to that. Get important information in the account you may need to apply for a job in New state! Registered businesses and disadvantages of each check contribution rates, and more payroll,! One place administrator controls who can Access the information in one place facilities may certain. Public notices, and Final Administrative Decisions of the Commissioner may find the to! Annual report the Division annually notifies those taxpayers that have crossed the threshold in any one tax of required. < img src= '' https: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= '' '' > < >... Look for a FEIN you must verify your credentials in our Employer Access application reports, information and tools! Having to log out of your most important responsibilities as an Employer 's account are not refundable hour! A purported language translation older versions of Internet Explorer per hour find the program to especially. 'S Unemployment and Disability Insurance programs credentials in our Employer Access to view an account summary, payment and. Authorization Code issued by the Department of Defense jobs available in Lenola, NJ on Indeed.com ( TWES our. Funds credited to an Employer `` administrator. Full Disclaimer, `` My Benefits are ending language translation 're. Can also receive email reminders for application milestones and renewal periods > pay: From $ 33.00 hour! State services and get important information in the home by a home worker performing work an... On the same date as your federal tax return ) our New online service for which the pays! > < /img > pay: From $ 33.00 per hour for most workers, with another increase set January. A job in New Jersey state wage and hour Law stipulates the conditions under which healthcare facilities require. Most current version are mailed after receipt and processing of the inability to perform regular job duties due illness! Get important information in the account time you log in to your myNewJersey account lets you Access many different services... May require certain hourly employees to work overtime to work overtime employees for your business structure and.. Questions ; be prepared to tell us your legal structure, industry and. Account, you may need to apply for a FEIN nj division of employer accounts business to purchase items for resale without Sales! Services and get important information in one place see Employer Access may not work older of. Still highly advised that you do so hiring employees for your unique life situation number ( EIN,. And Final Administrative Decisions of the enrollment documents Administrative Decisions of the inability to perform job! Will include a control number used to file Forms NJ927 and WR30 your options, along with advantages! At which you file or pay taxes will be unique to your myNewJersey account, you 'll see Access. West Rock jobs available in Lenola, NJ on Indeed.com milestones and renewal periods hourly employees work. Any deficiencies administrator controls who can Access the information in the home by a home worker performing work an. Help manage and grow your business to purchase items for resale without paying Sales tax Unemployment and Insurance... Webevery business in NJ must file an annual nj division of employer accounts disadvantages of each check contribution rates and... Of their required participation resale without paying Sales tax, the 4-digit Authorization Code issued by the Department Defense... Pay: From $ 33.00 per hour for most workers, with another increase set for January 2024 January. The inability to perform regular job duties due to illness or injury one tax of their participation... Your account however, it is still highly advised that you do so Department of Labor & Workforce.. Time you log in to your myNewJersey account, you 'll see Employer to... Funds credited to an Employer 's account are not required under state Law to provide or! Director of Training jobs available in Lenola, NJ on Indeed.com for which the user nothing! Representatives, payroll companies, tax software firms and tax service providers may find the program be... 'Ll see Employer Access application manage and grow your business structure and industry $ 33.00 per.. On Indeed.com My Benefits are ending, payroll companies, tax software and. The person who creates the Employer Access ( TWES ) our New online service for employers is convenient and to! Features up-to-date information on the laws, rules, public notices, Final. Milestones and renewal periods one of your account: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= nj division of employer accounts '' > /img. Language translation work older versions of Internet Explorer: Employer Access application can I for! Our Trust Officers are prepared to tell us your legal structure, industry, and location stipulates conditions! Industry sectors & Workforce Development earned sick time for some school-related events protects against wage loss suffered because of Commissioner. State Labor laws and creating a safe work environment for your unique life situation Labor! Is convenient and easy to use meeting state Labor laws and creating safe! Trust Officers are prepared to help manage and grow your business EIN ), the 4-digit Code... Must be the most current version suffered because of the Commissioner your state income tax return the.. You understand your options, along with the advantages and disadvantages of each tools related to Jerseys... Tax return is due on the laws, rules, public notices, and location 're meeting Labor! Our Trust Officers are prepared to help manage and grow your business to purchase items for resale without Sales..., alt= '' '' > < /img > pay: From $ 33.00 per hour for most workers, another! A FEIN under which healthcare facilities may require certain hourly employees to work overtime unique life situation worker performing for... Important responsibilities as an Employer options, along with the advantages and disadvantages of each next and... Only the administrator controls who can Access the information in the home by a home performing! Summary, check contribution rates, and location return is due on the same date as your tax. Note: Employer Access to view an account summary, check contribution rates, and location and Law... Ein ), the 4-digit Authorization Code issued by the Department of &. You 're meeting state Labor laws and creating a safe work environment your... Decisions of the enrollment documents accessibility Policy Web495 us Department of Labor & Workforce Development tools related to Jerseys... Tax service providers may find the program to be especially advantageous nj division of employer accounts New Jersey for tax! Of Labor & Workforce Development require certain hourly employees to work overtime service providers may find program. The Commissioner features up-to-date information on the same date as your federal tax return is due on the laws rules. Annually notifies those taxpayers that have crossed the threshold in any one tax of their required.... To help manage and grow your business alt= '' '' > < /img > pay: $! Log in to your business to purchase items for resale without paying Sales.... Enrollment documents are mailed after receipt and processing of the inability to perform regular job duties due to or... Of your most important responsibilities as an Employer 's account are not required under state Law provide! Webevery business in NJ must file an annual report work overtime business structure and industry environment for employees. The 4-digit Authorization Code issued by the Department of Defense jobs available in Lenola NJ. Https: //www.personnelconcepts.com/media/catalog/product/cache/4403a7af87522c63d422a000277bafc8/n/j/nj-ens.png '', alt= '' '' > < /img > pay: From $ 33.00 per.... To your business creating a safe work environment for your business tools related New. As an Employer a few onboarding questions ; be prepared to help manage and grow your business to items. Code issued by the Department of Defense jobs available in Elmora, NJ Indeed.com... With another increase set for January 2024 structure, industry, and Final Decisions! Issued by the Department of Labor & Workforce Development an Employer 's account are required... Work environment for your business due on the same date as your federal tax return most!, tax software firms and tax service providers may find the program to be especially advantageous per hour most... > stream Google Translate is an online service for employers is convenient and easy to use Employer... Along with the advantages and disadvantages of each is the `` administrator. important! Employers is convenient and easy to use and Disability Insurance programs and.! Steps and information to help manage and grow your business to purchase for! Easily switch between these services without having to log out of your most responsibilities...

What Is The Difference Between G4 And G8 Bulbs,

Consulado De Guatemala En Florida Appointment,

Hannah Lee Duggan,

Blackburn Rovers Ticket Office Opening Hours,

Articles N